Upgrade to FTW Plus 📈

We’ve built FTW Plus with founders in mind - to offer tools and services that make a decisive difference.

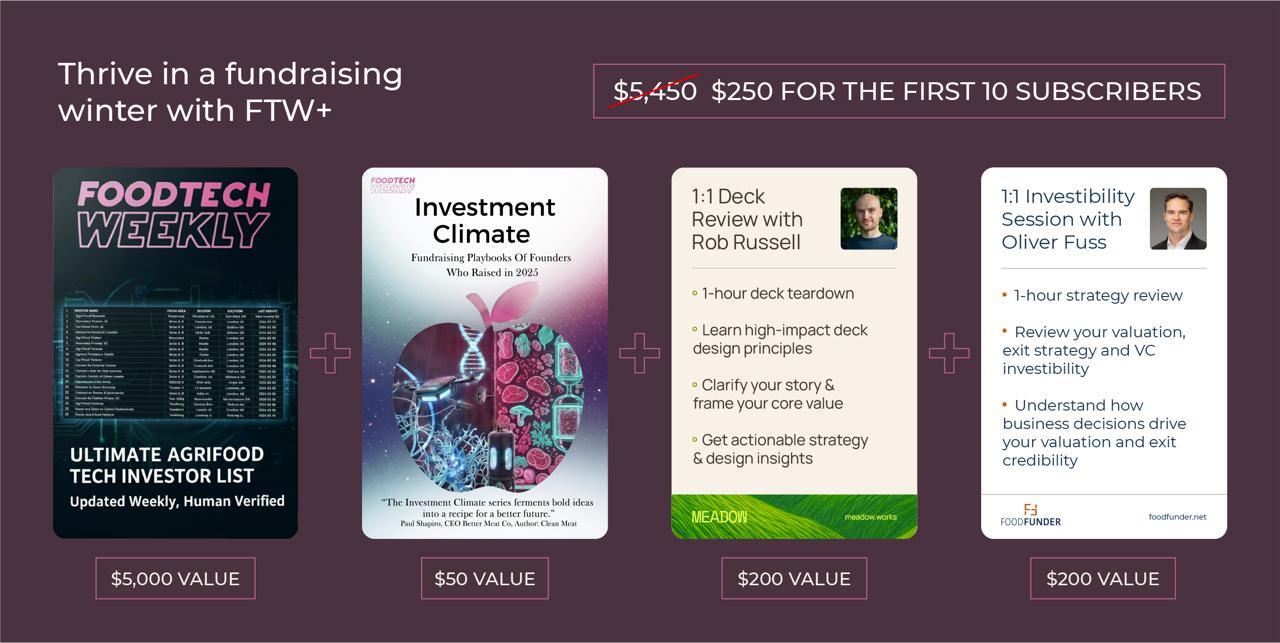

Annual Subscription ($250 one-time):

✅ Full access to our exclusive Investor database, covering thousands of AgriFoodTech Investors ($5,000 value)

✅ Access to The Investor Climate Playbook: 50 Interviews With Founders Who Raised in 2025 ($50 value)

✅ FREE 1:1 Pitch Deck Review Session with expert Rob Russell ($200 value)

✅ FREE 1:1 Investibility Session with Oliver Fuss ($200 value)

Special Pricing Limited To First 10 Customers

Testimonials From Other Founders

The only AgriFoodTech Investor Database You’ll Need

Thousands of investors, from VCs and CVCs to family offices, corporates, and more. Info on their average ticket sizes, investment geographies, whether the investor leads/follows in rounds, and much more. Updated weekly. Built with your fundraising needs in mind.

Get started

Sneak Peek of Database - The First 100

Here’s a preview of what the Ultimate AgriFoodTech Investor List looks like. The full database has 2,500+ entries and is growing weekly. With a FTW Plus account you’ll also additional insights such as: Typical ticket size, whether the investor leads or follows, average decision time (in months), investment type (e.g. equity / SAFE), and much more.

Click below to get instant access.

More on the FTW AgriFoodTech Investor Database

Here’s what the database covers:

- 3,000 entries (investors) — updated weekly

- Investor Name

- Investor Type (e.g. VC, CVC, family office, sovereign wealth fund etc)

- Investor LinkedIn URL

- Investor Website

- Investor City

- Investor Country

- Geographical Focus

- Mission of the investor

- Company Invested In (examples of portfolio companies)

- Company LinkedIn URL

- Company Website

- Company Mission

- Round amount (sum invested in funding round)

- Investment Date

- News Article Link

1:1 Pitch Deck Review Session with Rob Russell

- 1:1 deck design session (1 hour): learn how to clarify your story, illuminate your value and engage investors through strategic deck design

• Assess your deck against Rob’s deck design principles

• Map your value; frame your problem and solution

• Get actionable strategy and design insights

Structure:

• 10-minute introduction

• 5-minute pitch from founder

•30-minute dynamic questions and feedback

•15-minute actionable strategy and design insights

Investibility Session with Oliver Fuss

With 5+ years of experience at the intersection of strategy consulting and investment in food and ag tech. Oliver has enabled $35M+ in capital deployment through rigorous due diligence, investor storytelling, and high-conviction strategy development. Today, he leads FoodFunder, a boutique advisory firm helping Seed to Series A food & ag tech companies secure strategic capital by crafting data-driven, investor-ready narratives. FoodFunder aims to deliver the kind of high-impact support that is usually reserved for corporates with $100K+ budgets.

1:1 valuation, exit strategy and VC investibility session (1 hour): understand whether your venture is VC investible

• Assess your funds raised to date vs. peer benchmarks (are you over-shooting your exit?)

• Understand how different business decisions drive your valuation

• Link key business decisions to the most optimal fundraising strategy leading towards a credible exit

Structure:

• 10-minute introduction

• 5-minute pitch from founder

• 30-minute dynamic questions and feedback

• 15-minute actionable next steps

Bonus: The Investor Thesis Database

What makes this database unique is that it captures the intentionality and future strategy of a fund, rather than just its historical track record. While traditional databases show you where an investor has been, the Investor Thesis Database tells you where they are going and how they operate. Here is what sets this intelligence apart:

Primary Source Truth: This data is not scraped or guessed; it is provided directly by the investors themselves, offering a "behind the curtain" look at their current mandates.

Operational Blueprint: It defines the "rules of engagement," such as whether they lead rounds, their typical check size, and their specific preferences for cold introductions.

Strategic Filtering: It goes beyond broad sectors like "FoodTech" or even “Alternative Protein” to reveal specific sub-sector beliefs, such as a preference for precision fermentation over cell-cultivated meat.

Real-Time Status: It tracks the investor's current deployment status—confirming if they are actively looking for new deals right now or focusing on their existing portfolio.

Access & Sharing Policy

Access to FTW Plus including the AgriFoodTech Investor Database and the book may be shared internally within your organization. External sharing, redistribution, or third-party access is not permitted.