#250

Hi there,

Some interesting funding rounds this week — from chemical-free weeding and smart beehives to atmospheric water generators and GLP-1 peptides. But not much activity around alternative proteins. When will we see a rebound in investor interest for this sector?

Also, I’m curious:

Which part of the newsletter do you get most value from?

Please vote ☝️🗳

This week's rundown:

💵 Rootwave bags $15M for chemical-free weeding

🤑 Tastewise nabs $50M to help food brands act smarter and faster

🚮 How supermarket multi-buy promotions lead to consumer food waste

Let's go!

Sponsored content:

StartEngine’s $30M Surge — Own a Piece Before June 26

Private markets are having a moment, thanks to companies like StartEngine.

The leading alternative investing platform is helping everyday investors like you access deals once reserved for VCs and insiders, including exposure to private market titans like OpenAI, Databricks, and Perplexity.¹

How’s it going? In Q1 2025, StartEngine pulled off $30M in revenue, its biggest quarter ever (based on unaudited financials).²

But StartEngine isn’t just a middleman. The company earns 20% carried interest on select pre-IPO offerings, unlocking value for shareholders when these deals succeed.³

How can you tap into this diversification play? By investing in StartEngine.

StartEngine has crowdfunded $85M+ to date, and you can join 45K+ shareholders before the company’s current round closes on June 26.

Reg A+ via StartEngine Crowdfunding, Inc. No BD/intermediary involved. Investment is speculative, illiquid & high risk. See OC and Risks on page.

💬 Conversation with Lauri Reuter, Nordic FoodTech VC

“I am a scientist by training. And I get really excited about all the stories of scientific discoveries changing our everyday life in very concrete ways. Think of the invention of antibiotics or vaccines. Think of pasteurization or electricity, or the Haber-Bosch process! In this line of work I get to imagine the future transformations of the same magnitude. So – talk to me about how life on the planet could be very different, and you will have my full attention.”

I just interviewed Lauri Reuter, Ph.D., Founder and Partner at Nordic FoodTech VC, for Solvable’s newsletter on his investment philosophy, sectors he’s excited about, and why the magic of seeing science being turned into reality brings him so much joy. Make sure to subscribe for future posts 📲.

Lauri Reuter, Nordic FoodTech VC

💰 Funding

🇬🇧 Rootwave has harvested $15M in funding led by Clay Capital and joined by e.g. Xinomavro Ventures plus existing investors like Rabo Ventures and PYMWYMIC. The company’s tractor-mounted machine passes an electrical current through weeds, obliterating up to 99% of unwanted plants in a chemical-free way.

🇮🇱 Beewise has announced a $50M Series D round, backed by e.g. Fortissimo Capital, Insight Partners, and APG Asset Management. The company has developed AI-powered (because after all, this is 2025!), solar-powered beehives that allow farmers to monitor bee colonies in real time, protecting them from threats like pesticides, heat stress, and pathogens. The company claims it can cut bee mortality by up to 80% and boost yields by at least 50%.

🇮🇱 Tastewise has raised a $50M Series B round led by TELUS Global Ventures and joined by Peakbridge, Disruptive AI, PICO Venture Partners, and Duo Partners. The company combines brand data with trillions of real-time food signals to automate marketing and sales, helping brands not just move faster and smarter but also cut food waste. Tastewise clients include some of the largest food and beverage companies such as Mars, Campbell’s, and Kraft Heinz.

🇹🇳 Kumulus Water has tapped investors for €3.1M ($3.6M); the company develops solar-powered, decentralized generators that turn air into drinking water. The round was led by Bpifrance and backed by e.g. PlusVC, Khalys Venture and Flat6Labs, plus family offices, angels, and Spadel, one of Europe’s leading bottled water companies.

🇮🇱 Lembas has come out of stealth with a $3.6M pre-seed round. The company has developed ‘GLP-1 Edge’, a bioactive peptide designed to trigger the same appetite-regulating pathway targeted by drugs like Ozempic, but delivered through everyday food and supplements, not injections. The funding round was led by FLORA Ventures and joined by e.g. Bluestein Ventures, Maia Ventures, Siddhi Capital, and Mandi Ventures.

Image: Lembas

🇵🇹 PFx Biotech has closed a €2.5M ($2.9M) Seed round led by Buenavista Equity Partners and joined by e.g. EIT and Beta Capital. The startup produces highly functional bioidentical human milk proteins through precision fermentation. The company also has secured a €2.5M ($2.9M) grant from the EIC SME Agency, taking total new financing to €5M.

🇸🇪/ 🇩🇰 Alba Health, a digital platform to support childrens’ gut health, has banked $2.5M in fresh funding from e.g Exceptional Ventures, Voima Ventures, and Unconventional Ventures.

🎙️ Investment Climate: Arthur Erickson of Hylio on how to get funded in 2025

This week, Alex Shandrovsky met with Arthur Ericksson, CEO and Co-Founder of Hylio, a Texas-based company deploying precision drone systems for agriculture. Arthur shares why they chose equity crowdfunding on StartEngine over traditional venture capital, citing the importance of control and understanding the ag industry’s unique economics. He also reflects on building community-driven support and explains why the future of agriculture looks like a robot revolution. Hylio recently raised about $2.5M via StartEngine. The full conversation can be found on Spotify and Apple.

Top three findings from this conversation:

Choosing Equity Crowdfunding Over Traditional VC. Hylio chose StartEngine for its flexibility, independence, and better alignment with its hardware and agricultural focus — areas VCs often misunderstand or undervalue. " We started looking at other options, and equity crowdfunding was very attractive. Ag is cyclical. There are ups and downs, and you have to roll with the punches and really understand the farmer and the end market to be successful here. And none of the institutional investors we talked to really got it up, so that's why we did it."

Preparation is Key: Financials and a Launch Plan. StartEngine requires two years of audited financials. A war chest (at least 10% of the raise) is needed for marketing. " You have to get audited financials, and this is an SEC requirement. StartEngine is the broker; they act as the middleman between you and retail investors, serving as the watchdog and enforcing SEC regulations. To maintain their certification as a broker, they require you to have at least two years of audited financials."

Early Bird Discounts: Creating Urgency. Offering early investment perks is a strategic lever. “ When the campaign first launches, there are a number of StartEngine early bird perks. In our case, you could stack perks as different percent categories and if you invested by certain criteria you could get as much as a 40% discount of the share price.”

🧐 Noteworthy

🌎 BioCraft's cultivated mouse meat emits 92% less emissions than beef byproducts in pet food, a new analysis by ClimatePartner demonstrates.

🧬 University of Oxford and Wild Bio will receive a £6.7M ($9.1M) grant from ARIA (Advanced Research and Invention Agency) to improve potato and wheat yields using synthetic biology.

🗑 Supermarket multi-buy promotions lead to over-purchasing by consumers, which lead to more edible food going into the trash, new research shows (as reported by Sophie Attwood, PhD)

🤝 Misfits Market, which started out by selling ugly or surplus produce online — has acquired The Rounds, a regional, member-based business that restocks essentials for shoppers using reusable packaging.

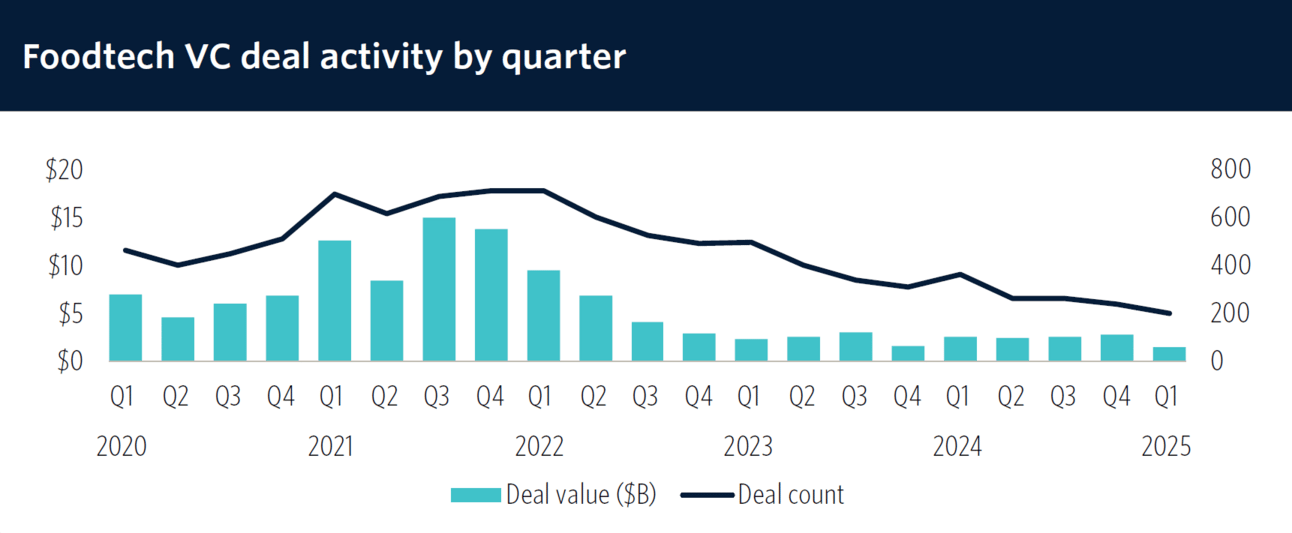

📉 FoodTech funding ‘slowed significantly’ in Q1 2025 as investors increasingly focus on AI, according to a new PitchBook report. The sector captured $1.4B across 202 deals during Q1, an almost 50% drop in capital vs. the same period last year. Median startup valuations in 2024 are also down by almost half compared to 2021. If you’re interested in alt protein investment trends, check out this recent Green Queen article.

Image: Pitchbook

🌍 News from the FoodTech Weekly community

🧑💼👩💼 What happens when you convene 450 people from 20 countries in the middle of nowhere in Finland to explore innovations in sustainable food chains and AgroTech, for AgriVenture 2025?

Sponsored content:

Smarter Investing Starts with Smarter News

The Daily Upside helps 1M+ investors cut through the noise with expert insights. Get clear, concise, actually useful financial news. Smarter investing starts in your inbox—subscribe free.

🎲 Random Stuff

👀 Scientists are binge-watching a website called Gulls Eating Stuff, where users upload photos of gulls devouring weird stuff (e.g. burgers, churros, Pacific octopus). The researchers hope to use the data to find ways of halting the decline in gull populations.

🌽 Vegetable-made sculptures of Pope Leo XIV, Dolly Parton, and Mohamed Salah were featured at a London competition recently.

🏃 When you’re running a marathon and a pizza delivery guy passes you.

🐟 Pet owners dump goldfish into waterways, not realizing they can live for up to 40 years and become huge.

😀 Slightly unhinged AI video of influencer doing street interviews with people in the 1500s:

I love you.

Daniel

- - -

🎵 This issue was produced while listening to God Only Knows by The Beach Boys.

🤳 Follow me on LinkedIn and X.

👉 Did your brilliant friend forward this to you? Subscribe here.

✏️ Start your own Beehiiv newsletter.

📈 As of today, FoodTech Weekly has {{active_subscriber_count}} subscribers, of which 63 are Premium. Please join them.