#262

Hi there,

If you’re going to The Drop, don’t forget to sign up for the Ripple I’m hosting with Sarah Jones of Zero Carbon Capital, “Decarbonising agriculture: how do we solve nitrous oxide emissions from fertilisers?” — sign up here.

This week's rundown:

🐟 SuperGround banks funding to turn fish and chicken sidestreams into protein

💡Orchard Robotics nabs $22M for AI system that helps farmers make crop decisions

🤝 Trading trash for food in India

Let's go!

Sponsored content:

Transform Customer Support with AI Agents

How Did Papaya Scale Support Without Hiring?

Papaya cut support costs by 50% and automated 90% of inquiries using Maven AGI’s AI-powered agent - no decision trees, no manual upkeep. Faster responses, happier customers, same team size.

💬 Conversation with Jens Thulin of Mylla

Frustrated by the food market concentration reducing consumer choice, blocking out smaller food producers, and forcing farms and food companies to shut down due to lack of distribution, Swedish farmer Jens Thulin decided to do something about it. Mylla was born — a SaaS platform and marketplace enabling producers to sell directly to consumers, businesses and the public sector. To learn more, I recently spoke to Jens — read the full convo here.

Jens Thulin / Mylla.

💰 Funding

🇫🇮 SuperGround has extended its round with an extra €1.15M ($1.34M), bringing the total to €3.65M ($4.25M). The extension round was led by CHECK25 Impact and Propeller Ventures. The company transforms undervalued fish and poultry sidestreams into high-protein products such as nuggets, patties, and burgers. (I interviewed the CEO of SuperGround, Jaakko Kaminen, for FTW last year).

🇺🇸 Orchard Robotics has harvested $22M in Series A, led by Quiet Capital and Shine Capital, and joined by e.g. General Catalyst. The company has developed e.g. a vehicle-mounted, AI-powered vision system that gathers data about plant health, helping farmers make critical crop management decisions. The company says it works with e.g. U.S. apple, grape, and strawberry farmers.

🇮🇳 WasteLink has closed a $3M Series A round, backed by Avaana Capital. The company upcycles surplus food into standardized feed ingredients for the animal feed industry. WasteLink says it has processed 35K tons of surplus food since inception.

🇸🇬 Singrow has raised a $4.5M Series A to scale its seed breeding and vertical farming business beyond Singapore and China. Investors included e.g. AgFunder, Cyanhill Capital and Pasudeco.

🇨🇭FOOD Founders Studio, which aims to commercialize ‘breakthrough food technologies trapped in R&D labs, starting with those of European universities’, has secured CHF 1.2M ($1.5M) from undisclosed private investors including a Swiss family office, and launched its first venture — a startup that tackles off-flavors in plant-based foods.

Alexandre Morel and Giacomo Cattaneo / FOOD Founders Studio

🎙️ Investment Climate: Cyrille Viossat of Fungu’it shares how to get funded in 2025

This week, Alex Shandrovsky met with Cyrille Viossat, COO and CTO of Fungu'it, a pioneering French startup dedicated to creating sustainable, natural aromatic ingredients through circular economy practices using filamentous fungi. The company recently raised €4M ($4.65M) led by Asterion Ventures, with participation from Evolem and UI Investissement via Oser BFC.

The full conversation can be found on Spotify and Apple Podcasts.

Top three findings from this conversation:

France Advantage: Non-dilutive funding, public infrastructure, and leverage. Significant grants, BPI debt, public hosting (equipment/expertise), plus a European grant with a Spanish partner. “France has government schemes, and we has won some schemes. It is a competitive application, and we came up with a research program that enabled us to fund our company.”

Traction over Patents (for this stage). Patents are in process, but investors prioritized market validation and paying customers. “We have started the process of getting our first patents, but we haven’t finalized it yet.”

Valuation Approach: Needs-based + market benchmarks; lead helped align syndicate. They triangulated from capital needed to hit milestones and peer benchmarks; lead investors advocated for their target valuation. “It was impossible for us to claim how much the company is worth. So we tried to come up with proxies, one of which, maybe the scariest, would be how much it would take a huge company to get to where we are. The thing is, our market traction was probably what made us feel confident that we could get a particular valuation. Now, of course, we all believe in our projects. To be honest, we had in mind a valuation that was slightly higher but not much higher, and we managed to convince the lead investor. The lead investor ended up making our case to the other co-investors for a valuation that was very close to what we had in mind.”

🧐 Noteworthy

🥇 Global Call for Startups, a competition for early-stage ventures dedicated to transforming the food systems, has announced 5 winners: Bioprime Agri Solutions, DE3PBIO, Farm to Feed, Instacrops, and Remy. More info here.

😵 U.K. cell ag startup CellRev has ceased trading and appointed administrators, as it ‘couldn’t deliver commercial milestones fast enough to secure Series A investment.’ In similar news, Dutch startup Vegan Finest Foods (which makes Vegan Zeastar) has declared bankruptcy following financial struggles.

🌲 CEForestry, a project led by SLU (the Swedish University of Agricultural Sciences) has found that compounds extracted from spruce needles can preserve food such as plant-based meat without artificial chemicals, and even improve the taste.

📈 Stockholm-based startup Karma, which initially became known for its food rescue app, has launched full stack restaurant platform KarmaOS and says it has crossed into profitability (after having raised around $20M over the years).

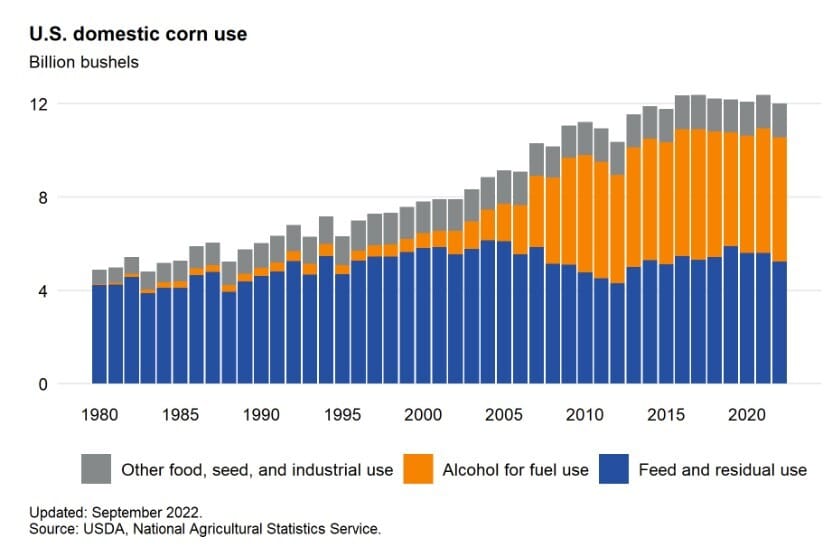

💡 Marion Nestle, professor emerita in food studies at NYU, shared the below image and noted that ‘if we want people to eat more healthfully, we need policies to make vegetables more widely available at lower cost. Farmers have to make a living. That’s why we need to rethink which foods get subsidized, and our entire agricultural system for that matter. How about redesigning the agricultural system to prioritize food for people, instead of feed for animals and fuel for automobiles?’

🌍 News from the FoodTech Weekly community

🏆 The VEGPRENEUR Awards highlights game-changing, plant-based CPG and consumer products from around the world while giving brands the opportunity to hear first-hand (and honest) feedback from industry decision-makers and tastemakers. All submitted products are tasted at exclusive tasting events held in New York City and Los Angeles. And all products submitted receive individualized feedback. Judges include investors, buyers, celebrities, influencers, and restaurant owners. Submissions are open now.

Want to share some FoodTech news/project with other FoodTech Weekly subscribers? Hit reply.

🎲 Random Stuff

🇺🇸🇪🇺 U.S. vs Europe on work/life balance (fun short clip!)

💸 Buy Now, Pay Later giant Klarna is IPOing, which makes me think of this old gem:

🤑 Speaking about money, you have a 1 in 578,508 chance of becoming a billionaire, and a 1 in 15 chance in becoming a millionaire.

🗑️ The Indian ‘garbage cafes’ where you can pay in trash (trading plastic waste for food).

🙀 Alt milk has gone too far this time, notes FTW reader Steve S:

I love you.

Daniel

- - -

🎵 This issue was produced while listening to QUE CE SOIT CLAIR by Paul Kalkbrenner & Stromae.

🤳 Follow me on LinkedIn and X.

👉 Did your brilliant friend forward this to you? Subscribe here.

✏️ Start your own Beehiiv newsletter.

📈 As of today, FoodTech Weekly has {{active_subscriber_count}} subscribers, of which 63 are Premium. Please join them.

Sponsored content:

Voice AI Security That Impacts Your Bottom Line

Learn how enterprise IT and ops leaders are using compliance to unlock Voice AI scale—deploying faster, reducing risk, and accelerating procurement.

This guide shows why HIPAA, GDPR, and SOC 2 are now deal-makers, not blockers. From securing PHI to routing across 100+ sites, see how security-first platforms reduce friction and enable real-world rollout across healthcare, insurance, and more.