#264

Hi there,

Went to The Drop (for the 4th year in a row) this week, joining 1,000+ climate investors and founders. A few quick reflections here on what makes The Drop not just a great but also a pretty unique event.

The Drop snapshots

Also, at The Drop event shop, I splurged €10,000 each on pre-melted iceberg water, SPF 1000 sunscreen, and a DIY carbon capture kit, and now I need to convince Accounting these are legitimate business expenses. But that feels like a problem for Monday.

This week's rundown:

🐮 Europe’s largest AgTech round for fenceless cattle collar

☀️ Big funding round for German agrivoltaics startup

🐝 New research breakthrough boost bee colonies by up to 15x

Let's go!

Sponsored content:

The best HR advice comes from people who’ve been in the trenches.

That’s what this newsletter delivers.

I Hate it Here is your insider’s guide to surviving and thriving in HR, from someone who’s been there. It’s not about theory or buzzwords — it’s about practical, real-world advice for navigating everything from tricky managers to messy policies.

Every newsletter is written by Hebba Youssef — a Chief People Officer who’s seen it all and is here to share what actually works (and what doesn’t). We’re talking real talk, real strategies, and real support — all with a side of humor to keep you sane.

Because HR shouldn’t feel like a thankless job. And you shouldn’t feel alone in it.

💰 Funding

🇳🇴 Nofence has herded some more cattle capital — a £26M ($35M) Series B round, that the company says is the largest European AgTech funding round of the year. The company sells solar-powered GPS collars that farmers put on cattle to control and monitor where animals graze in real time, without physical fences. The funding round was led by European Circular Bioeconomy Fund and backed by Capagro, Nysnø Climate Investments, Climate Innovation Capital, and Speedinvest.

🇫🇷 Online organic supermarket La Fourche has filled the cart with €31.5M ($37M) in funding led by Bpifrance and Astanor. Since starting in 2018, La Fourche has grown to 150K members and €100M ($118M) in revenue, and aims to be profitable by the end of this year.

🇮🇱 Finally Foods has announced a $1.2M investment into the firm from major beverage and dairy producer CBC Group, which also becomes the first significant customer for Finally. The plant molecular farming startup genetically engineers plants to make them produce dairy proteins such as casein, that can then be extracted and used.

🇸🇬 Terra Oleo, which turns agro-industrial waste into sustainable alternatives to palm oil and cocoa butter, has bagged $3.1M in funding from ADB Ventures, The Radical Fund, Elev8.vc, Better Bite Ventures, and a “strategic corporate investor” from the palm oil industry.

🇩🇪 Feld.energy, which sells a modular PV system that allows farmers to grow food and generate solar power on the same plot of land, has harvested €10M ($11.8M) in Seed funding in a round led by HV Capital and joined by e.g. AENU, Future Energy Ventures, and Angel Invest.

feld.energy

🇳🇱 Time-Travelling Milkman has closed a pre-Series A round of €2M ($2.3M), backed by new investors Sparkalis (of chocolate company Puratos) and Evercurious VC, as well as existing investor Oost NL. The company uses sunflower seeds to replace dairy fats in products such as cream cheese and desserts.

🇩🇰 SUMM Ingredients (rebranded from Nutrumami) has scored €1.7M ($2M) in funding from new investors EIFO and Box One as well as existing investors Kost Capital and Planetary Impact Ventures. The startup develops multifunctional, fermented proteins that allow food producers to create clean label, plant-centric foods that are ‘healtthier, more flavorful, and far simpler to formulate’, according to SUMM Ingredients.

🇮🇳 Biokraft Foods has raised a ₹2 crore (about $230K) from GVFL to develop and sell cultivated meat to Indian customers. The startup has already developed cultivated chicken [a ‘crore’, by the way, is 10 million].

🇬🇭 Legendary Foods, which uses parm larva to turns hundreds of tons of agricultural sidestreams into affordable nutrition as well as organic fertilizer for smallholder farmers every month, has secured funding from Alliance Management, Baylis Emerging Markets, Climate Resilience Africa Fund, Africa Business Angel Network (ABAN), MotherFood International, Dakar Network Angels and DeveloPPP Ventures and three Toniic members, including Katapult. The company, which has 60 staff, will now expand into the Republic of Congo.

🎙️ Investment Climate: Roman Lauš of Mewery on how to get funded in 2025

This week, Alex Shandrovsky met with Roman Lauš, founder & CEO of Mewery, a cultivated-meat startup in Czech Republic building a co-culture platform that combines animal and microbial cells to produce pork and other products more efficiently. Roman breaks down the real lessons: founders should invest their own capital, prove a fast proof-of-concept, differentiate deeply (their proprietary co-culture is the edge), and never bank on a verbal “yes.” We also get a frank look at why Roman is still bullish on cell ag (costs plummeting, second-generation tech, traction over hype) and what Mewery needs next: collaborations with meat and food manufacturers to bring products to market.

Mewery recently raised €3M from the European Innovation Council (EIC) Accelerator, and from the Horizon Europe research program.

Top three findings from this conversation:

Capital Stack v1: Validate, Then Amplify. After friends/founder money funded initial tests, Big Idea Ventures invested (~2022), triggering strong inbound and a total of ~€800k with local funds (Power Pro Ventures, Credo Ventures) and a small grant. "Big Idea Ventures… decided to invest in us, and this was the highlight of our company because we were the only startup from the Czech Republic who has ever been funded by this fund. We just released a press release, and the next day, I woke up to my inbox being full of not spam, but more than a hundred emails from investors and partners.”

Market Reality: Believe Actions, Not ‘Yes’. Verbal enthusiasm ≠ capital; keep parallel processes alive until money is wired. " I don't believe in ‘Yes’ anymore. This is very sad because if you tell me yes, I think you mean yes, but maybe it's my understanding of yes. It's not their mistake, because they want to have you in the process. We actually hang on to one investor. We thought that was it, and it took six months. We were running out of funds, and I thought this was a done deal. I don't need to look for more investors. So this is what I would change, and I think every experienced founder with fundraising would tell you the same.”

Grant-First Strategy to Advance TRL. Mewery rebalanced away from VC chasing to grants (incl. EIC Accelerator), learning to write/rewrite applications, hiring an agency, and using the process to harden the R&D and commercialization roadmap. " We reapplied for some of the grants , and with the EIC accelerator, we started very early . Everybody was telling us, ‘Guys, you are too early for that. You are not in this technical readiness.’ And we were not at that time, but I said, " It doesn't matter. We will grow into it. Let's not postpone it.’ I had a gut feeling we needed to write it because, for us, it was very important to formulate and articulate our experiment, roadmap, and business strategy. Thanks to this agency, we basically reformulated and redone the whole strategy into the whole business development and the licensing model we have today.”

🧐 Noteworthy

🍫 California Cultured has filed a patent covering the production of cocoa butter in plant cell culture, an industry first.

🐛 Singapore-startup Full Circle Biotechnology has raised funds to build a 7,000-ton/year insect protein facility north of Bangkok, Thailand. The factory will produce protein meal that combines black soldier fly larvae and microbial protein, and that can replace “up to 75% of fishmeal” in aquaculture.

💵 Mad Capital has closed its Perennial Fund II at $78.4M. It will provide U.S. farmers with loans to help them transition to regenerative-organic farming practices and simultaneously boost farms’ long-term profitability. Early commitments came from The Rockefeller Foundation, impact investment platform Builders Vision, and the Schmidt Family Foundation, AFN notes.

📈 Obesity now exceeds underweight for the first time among school-age children and adolescents globally, UNICEF says. Already, 1 in 10 children worldwide lives with obesity.

🏭 Aleph Farms has struck a deal to produce its cultivated meat in Europe, at The Cultured Hub facility in Kemptthal, Switzerland, Green Queen reports.

Aleph Farms

🐝 Scientists from the University of Oxford, Royal Botanic Gardens Kew, University of Greenwich, and the Technical University of Denmark have — after 15 years of research — managed to develop a ‘superfood’ for honeybees that help colonies have up to 15x more babies. The food is produced using a genetically engineered yeast.

🥛 Strauss Group is launching cow-free milk and cream cheese using precision-fermented whey protein produced by Imagindairy.

⬆️ ÄIO of Estonia, which uses biomass and precision fermentation to turn industrial side streams into non-animal fats and non-vegetable oils, has completed its first full-scale production run of 1 ton. This is a 300x increase vs the previous lab-scale production.

🌍 News from the FoodTech Weekly community

👨🏻💻 Melt&Marble (🇸🇪) is hiring a Head of Business Development & Sales.

🗳️ Make pooled-investor decisions fast and compliant: set up a vote, share a link, get weighted results. For access or info, email Jakob or check out the beta: https://pactum.ink.

🌟 AgriFoodTech innovators - your moment to shine has arrived! Join the leading league of FoodTech pioneers. Now in its 7th edition, Forward Fooding opens its applications to join the ranks of the most innovative and impactful AgriFoodTech entrepreneurs globally in the 2025 FoodTech 500. Submit your application here.

Want to share some FoodTech news/project with other FoodTech Weekly subscribers? Hit reply.

Sponsored content:

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

🎲 Random Stuff

🍝 A national ravioli reserve? Germany’s ag/food minister is calling for more ready-to-eat meals in the national stockpile, such as canned ravioli.

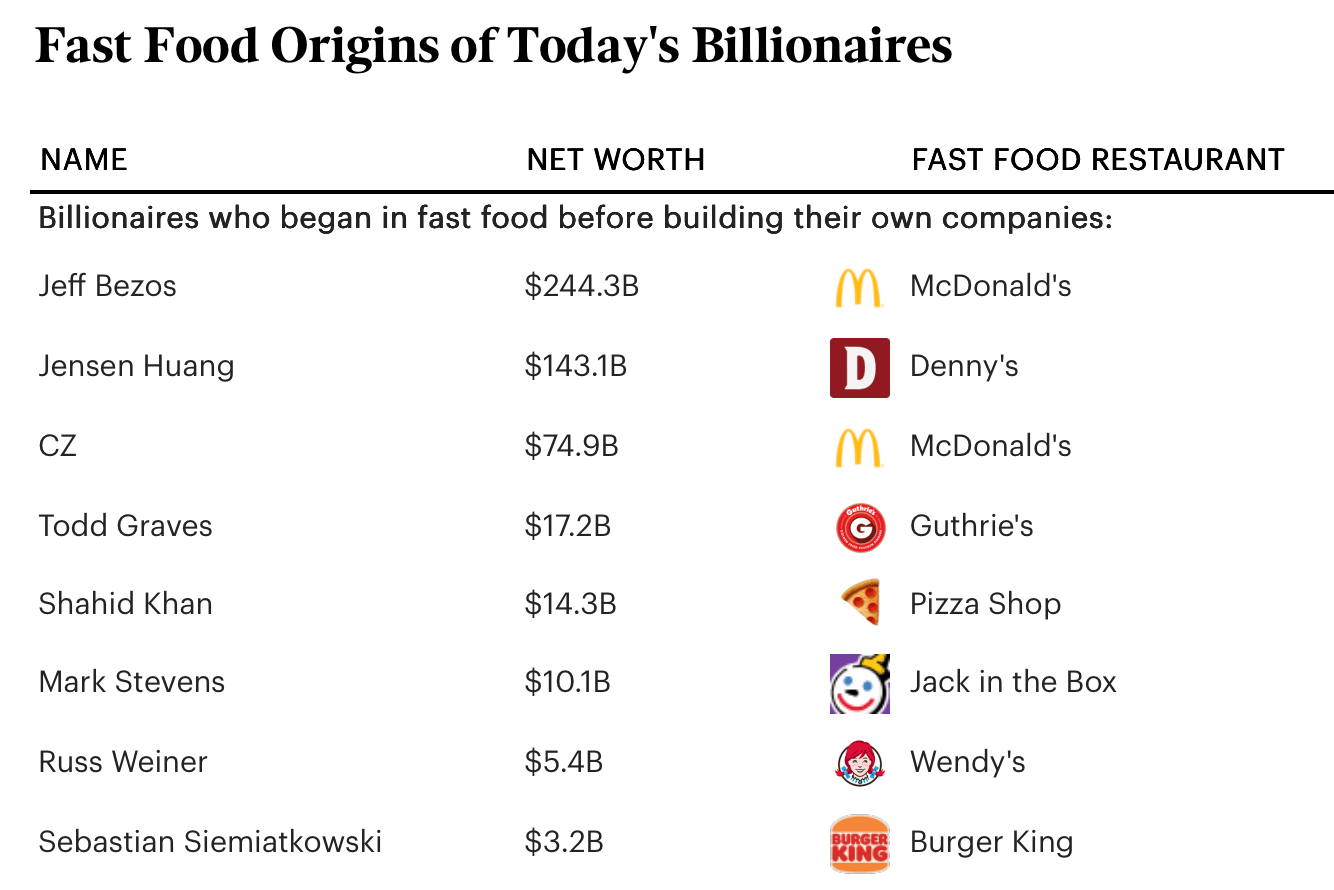

🍔 The billionaire entrepreneurs who started out working at fast food chains:

I love you.

Daniel

- - -

🎵 This issue was produced while listening to Elle by ISÁK.

🤳 Follow me on LinkedIn and X.

👉 Did your brilliant friend forward this to you? Subscribe here.

✏️ Start your own Beehiiv newsletter.

📈 As of today, FoodTech Weekly has {{active_subscriber_count}} subscribers, of which 63 are Premium. Please join them.