#273

Hi there,

Daniel here — back in February I wrote that I was looking for a new role. Countless people reached out with support in different ways (for which I’m eternally grateful). I actually started an exciting new role in April, but haven’t announced it — until now.

This week's rundown:

🇩🇰 Chromologics raises €7M for fermentation-based natural colorants

🇬🇧/🇮🇹 Biocentis banks $19M for its genetic insect-control technologies

🧀 Alt-cheese consolidation: Julienne Bruno rescued; PlanetDairy buys Stockeld assets.

Today’s newsletter was sent to {{active_subscriber_count}} subscribers. Welcome to FoodTech Weekly.

SPONSORED:

84% Deploy Gen AI Use Cases in Under Six Months – Real-Time Web Access Makes the Difference

Your product is only as good as the data it’s built on. Outdated, blocked, or missing web sources force your team to fix infrastructure instead of delivering new features.

Bright Data connects your AI agents to public web data in real time with reliable APIs. That means you spend less time on maintenance and more time building. No more chasing after unexpected failures or mismatches your agents get the data they need, when they need it.

Teams using Bright Data consistently deliver stable and predictable products, accelerate feature development, and unlock new opportunities with continuous, unblocked web access.

FUNDING

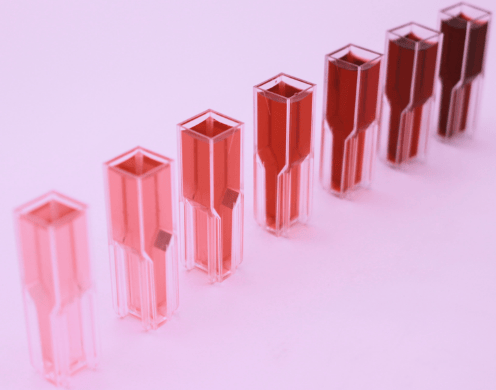

Red colors and all kinds of robots like Thor

Image credit: Chromologics

🇩🇰 Chromologics, €7M ($8M), fermentation-based natural colours. Investors: Novo Holdings, EIFO (the Export and Investment Fund of Denmark), Döhler Ventures, Collateral Good Ventures and Synergetic.

🇬🇧/🇮🇹 Biocentis, $19M, developing genetic approaches to insect control. Investors: The Grantham Foundation, Algebris Investments, Neurone, Corbites, Novaterra, angel investors, plus a $6M grant from Wellcome.

🇦🇺 Number 8 Bio, $11M Series A, methane-reducing livestock feed additive. Investors: Icehouse Ventures, Main Sequence and One Innovators.

🇮🇱 IBI Ag, $10M Series A, sustainable insect pest crop protection. Investors: Corteva Catalyst, The Trendlines Group, Iron Nation, Consensus Business Group (CBG), Israel Innovation Authority, Bandera Capital and First Imagine Ventures.

🇫🇮 Kääpä Biotech, €9M ($10.3M), clinically validated functional mushroom ingredients. Investors: Peakbridge and Zintinus.

🇪🇸 Voltrac, €7M ($8M), developing fully electric unmanned ground vehicles (UGV) called Thor, designed for autonomous farm tasks. Investors: Extantia, FoodLabs, Antler, PUSH, and Prototype Capital.

🇺🇸 Bindwell, $6M Seed, next-generation AI-powered targeted pesticides. Investors: General Catalyst and A Capital (h/t FoodHack).

🇸🇬 Anomaly Bio, $2.6M, transforming simple sugars into functional ingredients for nutrition, crop protection, and personal care. Investors: pebblebed + angels.

🇫🇷 Exwayz, €1M ($1.1M), real-time GPS free navigation software for autonomous systems such as robot fleets. Investors: CentraleSupélec Venture, including a grant from the France 2030 i-Lab Innovation Competition.

🇩🇪 HandsOn Robotics, new funding (undisclosed sum), robotic systems for commercial kitchens. Investors: TGFS, Gigahertz Ventures, superangels, and angel investors.

INVESTMENT CLIMATE PODCAST

Ori Cohavi and Yochai Maytal of Remilk share how they created real dairy without cows

This week, Alex Shandrovsky met with Remilk Co-Founder & CTO Ori Cohavi and Upstream Bioprocess Lead Yochai Maytal: “We break down the blind taste tests (including my own), why their milk froths, cooks, and tastes indistinguishably from traditional dairy, how they achieved positive gross margins at industrial scale, and the strategic JV model that’s letting them enter the market differently from any other precision-fermentation company. We also dig into past challenges, the truth behind the board shake-up, global expansion strategy, the path to competing with subsidized dairy, and what it will take for Remilk to reshape the global dairy industry.”

The conversation can be found on Spotify and Apple Podcasts as well as a written interview here.

Top three findings from this conversation:

75% Less Sugar, Same Experience. By removing lactose, Remilk eliminates the natural milk sugar that quietly adds 5% sugar to every glass. They replace it with a much smaller amount of “table sugar,” leveraging its higher sweetness to keep the sensory profile while cutting total sugar by 75%. The result is a product that tastes like regular milk, with a similar sweetness perception but far less sugar load. This gives them a strong “better for you” angle without asking consumers to sacrifice taste.

The JV Model: Tech & Brand as Equal Partners. Rather than just selling ingredients, Remilk built a full joint venture with Gad, one of Israel’s premium dairy brands (~₪1B+ business). Remilk brings the protein, formulations, and process know-how; Gad brings market knowledge, brand trust, and distribution. “ We are responsible for the technology, for supplying the end products, and Gad is mostly responsible for the marketing efforts for the distribution. But I think what we are doing is much more than co-branding, so it's much more than being an intel inside or remake inside. When I look at a partnership with Gad and why I think it's going to work, it's because each side brings its strength and each one is complemented by the other in its weaknesses.”

Already Positive Gross Margins (Atypical in Food Tech). Unlike most novel food companies that subsidize early sales, Remilk says it wouldn’t launch if it weren’t already gross-margin positive. Milk is the hardest product economically, but they balance it with other higher-margin products in the portfolio. They emphasize that they waited until both taste and unit economics reached a minimum bar before going to market, and that they’ve made major efficiency gains in strain performance and process design. “ We are able to reach this positive margin, not only because of milk, which is really the hardest product to reach, but also because we are going to launch other products with a very good margin that actually support the whole package that we are going to launch. But we are already at the point where we are positive. Otherwise, we would not go into the market. We made a huge breakthrough in the efficiency of the strain and the ability to scale up.”

NOTEWORTHY

Alt-Cheese musical chairs: Julienne Bruno gets rescued, PlanetDairy grabs Stockeld’s toys

🧀 Amidst the ongoing consolidation in the alternative protein space, U.K. plant based cheese brand Julienne Bruno has been acquired out of administration by The Compleat Food Group, while Danish alt cheese startup PlanetDairy has acquired select equipment and tech knowhow from now-defunct Stockeld Dreamery.

🇫🇮 Finnish company Collo has developed radiofrequency powered “liquid intelligence” to cut water waste and product loss in beverage and dairy production, replacing outdated sensors and saving manufacturers millions through real-time, automated process control (h/t FoodHack).

🇨🇭 Ingredion has partnered with Swiss FoodTech startup Cosaic to commercialize Cosaic’s yeast-based clean-label ingredient that enhances creaminess, stability in nutrition in plant-based as well as dairy products.

🦗 Edible insects were once the future of food — so what happened?

🍫 Kokomodo has teamed up with Chocolats Halba, a part of Switzerland’s largest retailer and wholesaler, Coop, to trial cultivated cacao in sustainable confectionery, testing performance and scalability as climate-driven cacao shortages worsen (h/t ClimateHack).

🦾 Israeli AgTech startup DailyRobotics is preparing to launch commercially in California next spring, with a robotic harvester that the company says can pick strawberries 2-3x faster than humans. Here’s the robot in action:

NEWS FROM THE FTW COMMUNITY

Join Nibblr as technical co-founder and help redefine food innovation

👨🏻💻 Nibblr is looking for a technical co-founder to architect and scale the core infrastructure behind a new intelligent operating system for food and drink innovation. The platform replaces slow, manual product development with real-time, evidence-led decisions, helping teams design, test and optimise products far faster. Supported by Nesta Mission Studio, and already working with brands, manufacturers and public health partners, Nibblr is building the operating system that will define the next era of food innovation. Contact Anna-Sophie Deetjen for more info.

🤝 Kirthi Gomatan is a former Bain consultant with experience across the US and Europe, now specialized in global food systems through an MBA in Food & Wine from Bologna Business School. She’s exploring both VC Investor roles in agrifoodtech, and Strategy, BizOps, or Chief of Staff positions at early-stage agrifoodtech companies (Seed–Series B). Based in Italy and looking to stay in Europe, she’s open to connecting with founders and investors. Contact: Email or LinkedIn.

SPONSORED:

74% of Companies Are Seeing ROI from AI.

Incomplete data wastes time and stalls ROI. Bright Data connects your AI to real-time public web data so you launch faster, make confident decisions, and achieve real business growth.

RANDOM STUFF

Rich people have left the chat + Spray it, don’t say it

😳 How the ultrarich are spending a fortune to live in extreme privacy (Wall Street Journal)

😲 Toyo Seikan of Japan has patented the world’s first cultured meat spray, enabling consumers to spray edible meat flavor and nutrition to e.g. rice, salads, or pet food instantly.

Image: Lab Grown Technologies

We love you.

Daniel & Ilkka

- - -

🎵 This issue was produced while listening to Veridis Quo by Daft Punk.

THE LEFTOVERS

Written by Daniel Skavén Ruben and Ilkka Taponen.

Did someone forward this email to you? Subscribe here.

Thank you for being a Premium subscriber! ❤️ It helps us cover the time and money we spend on producing FoodTech Weekly.

THE LEFTOVERS

Written by Daniel Skavén Ruben and Ilkka Taponen.

Did someone forward this email to you? Subscribe here.

Become a Premium subscriber of FoodTech Weekly for just $5/mo. This helps us cover the time and money we spend on paid newsletters and databases to stay updated on the FoodTech ecosystem. And you’ll get rid of ads. Plus, we’ll send you a food-themed book that we love, once a year.