#276

Hi there,

🌅 Daniel here — greetings from Stockholm, where sunrise today was at 8:35am (and sunset is at 2:47pm). Sending my thoughts to Ilkka over in Helsinki, where sunrise is at 9:15am local (and the sun sets at 3:12pm). We’re basically living inside a fridge with a flickering light bulb.

It’s been a quiet week for big funding news or scientific breakthroughs in FoodTech and AgTech. On the other hand, we’re bringing a fun story about a drunken raccoon in the Random Stuff section to make up for it.

This week's rundown:

💶 Melt&Marble raises €7M ($8.2M) for designer fats

💲 All G Foods secures A$10M ($6.6M) for precison-fermented lactoferrin

💰 FoodLabs closes €105M fund for investing in sustainable food startups

Today’s newsletter was sent to {{active_subscriber_count}} subscribers. Welcome to FoodTech Weekly.

SPONSORED:

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

FUNDING

Fats, Ferments & Baby Formula Get Funded

Image credit: Melt&Marble

🇳🇴 Flocean, $22.5M, subsea desalination technology. Investors: E.g. Xylem, Burnt Island Ventures, Freebird Capital, Katapult Ocean, Nysnø Climate Investments, Orion, Rypples and Water Unite Impact Fund.

🇸🇪 Melt&Marble, €7M ($8.2M), designer fats in beauty and food. Investors: Round led by Industrifonden and followed by European Innovation Council, Beiersdorf, Valio, Chalmers Ventures and Catalyze Capital.

🇦🇺 All G Foods, A$10M ($6.6M) convertible note, precision-fermented lactoferrin proteins. Investors: E.g. Agronomics, Döhler Ventures, and ID Capital.

🇧🇷 Harmony Baby Nutrition, R$31.8M ($5.8M), developing breast-milk-inspired infant formulas through fermentation. Investors: The Brazilian Development Bank (BNDES) and Finep (Brazilian Innovation Agency).

🇿🇦 Immobazyme, R25 million ($1.5M), precision fermentation enzymes and growth factors for e.g. food and beverage applications. Investors: The University Technology Fund (UTF II), Fireball Capital and University of Stellenbosch Enterprises (USE).

INVESTMENT CLIMATE PODCAST

Gerit Tolborg of Chromologics on how to get funded in 2025

This week, Alex Shandrovsky met with Gerit Tolborg, CEO and Co-Founder of Chromologics, to discuss how to turn a PhD discovery—a fungus that naturally makes a brilliant red pigment—into a venture-backed ingredient company on the brink of FDA/EFSA submission. Chromologics develops fermentation-derived, natural food colors to replace unstable, supply-constrained, and animal-derived reds. The company recently raised €7M from Novo Holdings, EIFO, Döhler Ventures, Collateral Good, and The Synergetic Group.

The full episode can be found on Spotify and Apple Podcasts.

Top three findings from the conversation:

When Your Biggest Risk Is Invisible: Fundraising Around Regulation. Chromologics deliberately raised a €7M internal round from existing shareholders instead of going to market. They’re at a sensitive regulatory inflection point where colors are “all or nothing” until dossier submission—something incumbents who’ve watched the journey can underwrite more easily than new VCs. This path lets Gerit focus on building and de-risking instead of burning months on data rooms and external DD for a hard-to-price stage. ” So from an outside investor, the risk-reward balance is maybe not so easy to grasp as from someone who's actually been following our journey all the way and really seen us step-wise, maturing and de-risking the regulatory process along the way.”

CDMOs Now, Strategic Exit Later. In today’s market, Gerit sees little sense in raising huge CapEx for a plant before proving commercial pull. Chromologics has already lined up a CDMO and designed its process to work at standard 100 m³ fermentation scale, where the economics make sense. Long term, she expects the real upside to be in a strategic exit: a large ingredient or food company plugging Chromologics’ IP and regulatory dossiers into its own, cheaper capacity. “ I think there's no investor right now that is willing to invest a hundred million euros into a CapEx project before I even have proof of business that might actually sell. I think that's not really realistic right now. Maybe it could have been in 2021, where we saw a lot of these projects popping up, also here in Denmark. What I think is more realistic is starting with the CMO, scaling it up five years into the market, and then, when you really see that there is the traction for the ingredient, people buy it.”

”From ‘How Does It Look?’ to ‘Describe Your Supply Chain.’ When Chromologics started, buyers led with: “Does it taste neutral? Is it stable? Does the red look right?” Now the first question is: “Tell me about your supply chain.” By delivering a plug-and-play red that is heat- and pH-stable and decoupled from vulnerable harvests, Chromologics can price on value: de-risked supply, label claims (e.g. nitrate replacement in cured meats), and application-specific solutions rather than just commodity pigment.

BONUS STORY — INVESTMENT CLIMATE PODCAST #2

Martin Davalos of McWin Capital Partners

Alex Shandrovsky had one more convo this week for the podcast, with Martin Davalos, Partner at McWin Capital Partners, to unpack how a serious food-tech investor actually thinks about this market. Alex says:

‘We talk about McWin’s unique model of combining one of Europe’s largest restaurant platforms with a focused food-tech fund, and how that creates real “farm-to-fork” synergies for portfolio companies. Martin uses The EVERY Company as a live case study—why McWin led both the Series C and now the Series D, what convinced them the tech and regulatory risk were truly de-risked, and why starting with bakery applications and egg replacement is such a powerful commercial wedge (price stability, guaranteed supply, and “better-for-you” fortification in products like high-protein donuts). We then dive into the hard stuff: down rounds, pay-to-play, milestones, follow-on decisions, and how founders should approach their existing investors long before runway gets short. Martin also explains why foodtech can still deliver solid VC-style returns—if you’re realistic about exits, obsessive about unit economics, and willing to build deep, hands-on relationships between founders and investors.’

The full episode can be found on Spotify and Apple Podcasts.

NOTEWORTHY

Hot water packaging, hot climate/food funds

NakedPak

👨🍳 NakedPak is developing edible, algae-based food packaging that dissolves in hot water while the food cooks. Cool video here.

😵 Cultivated meat pioneer Believer Meats, which had raised hundreds of millions, secured FDA and USDA approvals, and just finished constructing a full-size plant, has ceased operations.

🧈 Mars Food & Nutrition is investing $20M to future-proof its rice supply chain. The new ‘Raising Rice Right’ platform helps global farmers adopt climate-smart practices, aiming to reduce water usage and emissions while securing yields against the growing threat of climate change (h/t ClimateHack).

🇦🇺 The state of Victoria has committed A$12M ($8M) for a new research hub and glasshouse to develop climate-resilient, sustainable crops.

🦗 Learning from the turbulent insect sector: The former Secretary General of the IPIFF (International Platform of Insects for Food and Feed) Christophe Derrien shares his insights following the negative news such as Ÿnsect closing down.

🌱 How researchers are exploring producing ammonia-based fertilizer without using fossil fuels.

💶 FoodLabs, which invests in European startups focused on creating a healthier, more sustainable food system, has raised its third fund, at €105M ($123M).

👨🌾 Investment firm Just Climate has secured $375M for its Natural Climate Solutions strategy to scale land-use and agricultural innovations that cut emissions and restore nature, backed by new and existing global institutional investors and including investments in platforms such as India’s AgroStar.

🇪🇺 Michael Dean, founding partner at AgFunder, offers many interesting insights and data points on how Europe can build a globally competitive agrifoodtech economy.

NEWS FROM THE FTW COMMUNITY

Fungi startups rise—and Food Founders want your next big idea

👨🏻💻 The Future is Fungi Award has now announced the pioneering fungi startup winners out of 187 startups applying worldwide, with the top 3 in sustainable food dyes replacing synthetic colours, sustainable surfactants for personal care & cosmetics, and MycoDigestible diapers with fungal technology breaking down the diaper.

For those interested in joining investing in some of the winning startups (or other fungi startups from the award deal flow), get in touch with Award Founder and Managing Partner in The Fungi VC, Susanne Gløersen. Investors can join the syndicate investment through Odin. Solvable Syndicate will also do a collaboration with The Fungi VC around a syndicated investment opportunity in the winning food dyes company, so stay tuned for more info.

💶 Food Founders Studio is looking for researchers and innovators interested in launching a new startup. Send your proposal to the Innovation Challenge 2025 by the 31st of January 2026!

SPONSORED:

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

RANDOM STUFF

A Six-Story World Tour: Wealth, Wildlife, Wisdom, and Winter Ice

Credit: Carsten Snejbjerg for The New York Times

🎼 When the Cellos Play, the Cows Come Home (from 2021, but still good). “It’s actually nice playing for cows,” said Gray. “We saw it in rehearsal—they really do come over to you. And they have preferences. Did you see how they all left at one point? They’re not really Dvorak fans.”’

🤑 In 2025, the number of world billionaires rose from 2,682 to nearly 3,000.

🎓 52 things I learned in 2025 (some interesting tidbits in here).

⚫ Why painting 1 wind turbine blade black could dramatically reduce bird collisions (btw, Norwegian startup Spoor just raised €8M / $9.4M to help avoid wildlife-related shutdowns).

🥶 The Italian coastal city of Pesaro just opened an ice rink in its central square — but the festive attraction immediately stirred controversy. This year, the rink was constructed around a statue of the late opera legend Luciano Pavarotti, leaving him frozen in place up to the knees. City mayor Andrea Biancini initially encouraged skaters to “give Pavarotti a high five” as they would glide past, but the remark was deemed disrespectful by Pavarotti’s widow, prompting Biancini to later issue a public apology.

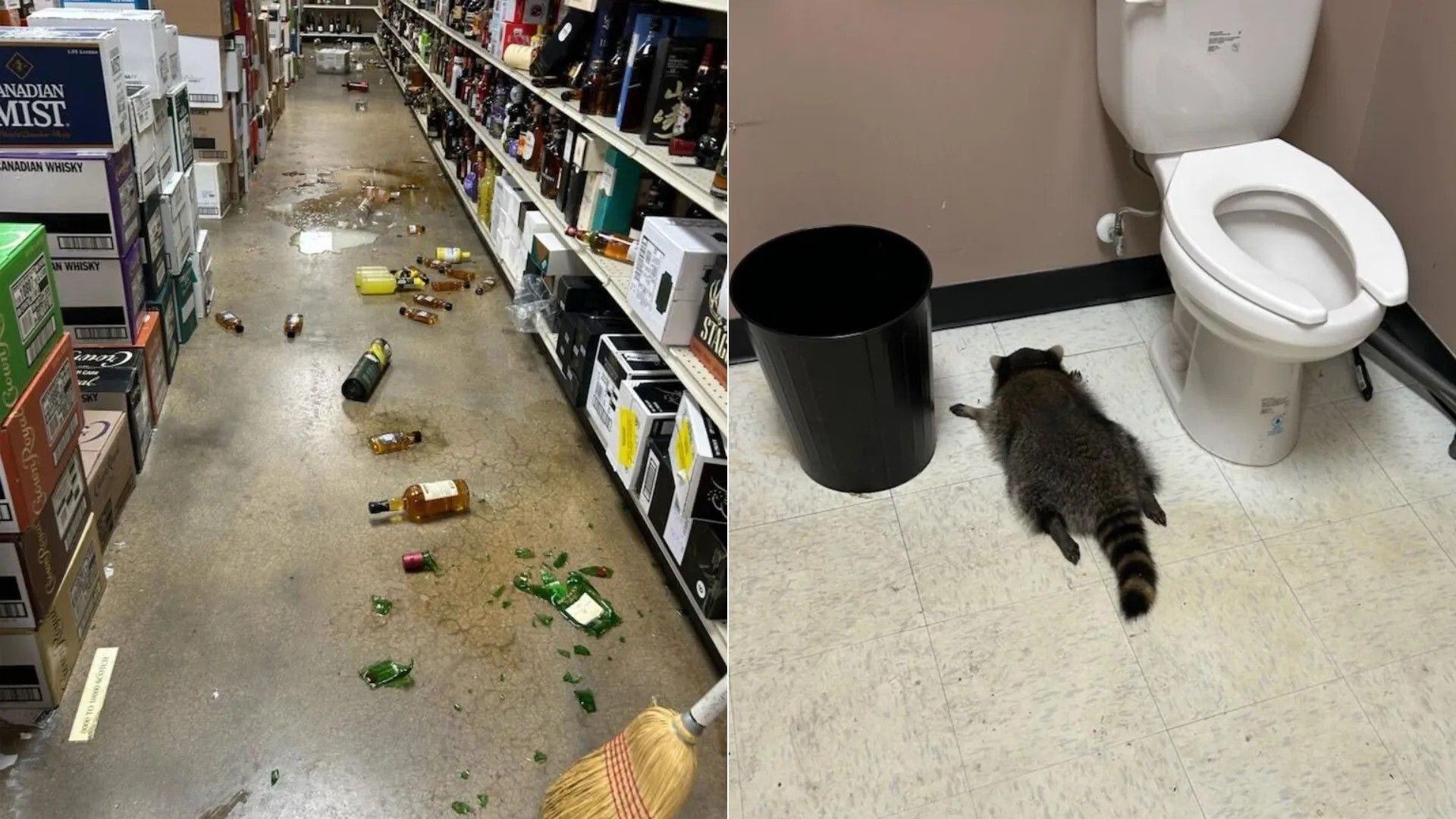

🦝 A drunken raccoon broke into a Virginia liquor store, trashed the place, and passed out in the bathroom. Animal control retrieved the uninjured “trash panda,” who sobered up and was released. Says The Hanover County Animal Protection and Shelter:“After a few hours of sleep and zero signs of injury (other than maybe a hangover and poor life choices), he was safely released back to the wild, hopefully having learned that breaking and entering is not the answer.”

We love you.

Daniel & Ilkka

- - -

🎵 This issue was produced while Daniel was listening to Insomnia by Faithless & Symphony of Unity, and Ilkka was listening to No Presents for Christmas by King Diamond.

THE LEFTOVERS

Written by Daniel Skavén Ruben and Ilkka Taponen.

Did someone forward this email to you? Subscribe here.

Thank you for being a Premium subscriber! ❤️ It helps us cover the time and money we spend on producing FoodTech Weekly.

THE LEFTOVERS

Written by Daniel Skavén Ruben and Ilkka Taponen.

Did someone forward this email to you? Subscribe here.

Become a Premium subscriber of FoodTech Weekly for just $5/mo. This helps us cover the time and money we spend on paid newsletters and databases to stay updated on the FoodTech ecosystem. And you’ll get rid of ads. Plus, we’ll send you a food-themed book that we love, once a year.