#277

Hi there,

As the year comes to a close, we wanted to express our quick thank-you to everyone who’s been reading, sharing, and replying to FoodTech Weekly. This space works because of curious founders, operators, and investors who care about how food actually gets produced, distributed, consumed, and discarded. People like you. More to come in the new year — but first, thanks for being part of it all.

For those of you who celebrate: Merry Christmas, Happy Chanukah, and a Happy New Year 🎄🕎🎆

Here’s some reflections on the FoodTech landscape 2025:

This was maybe the year the AgriFoodTech bubble finally settled into a more rational, industrial phase. Unlike 2020, investors are no longer funding pure vision — they’re choosy, and prefer teams with clear unit economics, proven routes to market, decent gross margins, differentiated IP, regulatory readiness, and viable pathways to profitability (and exits).

Funding is alive — but concentrated in certain tech areas (e.g. precision fermentation, designer fats, ag AI, robotics and automation, innovative ingredients such as cocoa and coffee alternatives, genomics, and seed tech). Investment levels have retreated to roughly 2015 levels — approx. $10B-$11B for the full year.

There’s been an AI premium — startups that are “AI first” in e.g. crop health, supply chain, and quality monitoring found it easier to raise than pure hardware plays without a data layer.

Alternative funding routes. Amidst cooled interest from traditional VCs, startups shifted to e.g. equity crowdfunding and non-dilutive funding (e.g. grants).

New venture funds and corporate capital are returning (e.g. Maia Ventures €55M fund, FoodLabs €105M fund, Oyster Bay Capital €100M fund). This shows LP/corporate interest is back for select AgriFood sectors.

Strong market correction / consolidation in alt protein, vertical farming, and insect protein — there’s been a wave of shutdowns, acquisitions and bankruptcies among alt-protein and indoor/vertical farming startups, after the earlier hype. For example, in cultivated meat Fork & Good acquired Orbillion Bio, and Gourmey acquired Vital Meat.

Startups failing/liquidating or warning big layoffs — there’s real operational/market pressures around e.g. distribution, margins etc hitting some startups.

Pragmatism has overtaken ideology. Founders like Paul Shapiro (The Better Meat Co.) are increasingly advocating for hybrid meat (plant/fungi mixed with animal meat) as a way to achieve mass impact and price parity quickly.

And with that, let’s get on with the show:

💶 Founteyn raises €19.3M ($22.6M) for capsule-based, bottle-free beverages

💶 The Green Dairy secures SEK 80M ($8.6M) to scale private-label plant dairy, backed by IKEA

🪦 AeroFarms shuts down, closing final farm and laying off hundreds

Today’s newsletter was sent to {{active_subscriber_count}} subscribers. Welcome to FoodTech Weekly.

SPONSORED:

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

CONVERSATIONS

Thijs Bosch of The Protein Brewery, on securing EFSA approval for a novel food ingredient

This week, Alex Shandrovsky spoke with Thijs Bosch of The Protein Brewery, to unpack one of the least glamorous — and most consequential — parts of food tech: regulation. Bosch breaks down what a positive EFSA opinion actually means (and why it doesn’t equal immediate market access), why timelines stretched far beyond initial expectations, and what it takes — financially and organizationally — to navigate the system without stalling the company. He also explains why being the first novel fungal biomass mycoprotein to receive a positive EFSA opinion matters, not just for The Protein Brewery, but for the broader fermentation ecosystem. For founders building regulated food ingredients, this is a rare look at how progress actually happens. Check out the full interview here.

FUNDING

IKEA and pension capital bet on packaging-free drinks and oat-based dairy

Image credit: The Green Dairy

🇺🇸/🇨🇦 BinSentry, $25M, in-bin sensors and machine imaging tech to help farmers monitor feed levels in real time. Investors: CIBC Innovation Banking.

🇳🇱 Founteyn, €19.3M ($22.6M) Series A, replacing single-use bottles and cans with concentrated capsules and on-site preparation. Investors: APG (on behalf of ABP), Flying Fish, and Leysern Aquacore.

🇦🇺 Squizify, $10M Series A, digital food safety company helping food industry actors automate hygiene tasks, digitize HACCP compliance, and monitor equipment performance. Investors: Coreline Ventures.

🇸🇪 The Green Dairy, SEK 80M ($8.6M), private label manufacturer of oat- and fava bean based products for other brands. Investors: IKEA via Ingka Investments.

🇳🇱/ 🇧🇪 Those Vegan Cowboys, €6.25M ($7.3M), precision-fermented dairy proteins. Investors: Pieter Geelen, Wouter Veenboer, Westland Kaas.

🇫🇷 Agreenculture, €6M ($7M) Series A, improving autonomy and safety of ag machinery and tractors. Investors: Supernova Invest, Future Food Fund and Unilis (Unigrains Group).

🇺🇸 Symbrosia, $5.8M, seaweed-additive to block cattle methane emissions. Investors: Idemitsu, One Small Planet and existing backers.

🇫🇷 Veragrow, $5.2M, vermicompost-based biostimulants producer. Investors: Odyssée Venture, Caisse d’Épargne Normandie, Groupe All Sun, and Normandie Participations.

🇫🇷 ReSoil, €4M ($4.7M), scaling regenerative agriculture projects and expanding its digital carbon-management platform. Investors: Banque des Territoires, InvESS Île-de-France Amorçage, and Generali Impact Investment.

🏴 MiAlgae, £3M ($4M), turning whiskey waste into algal omega-3. Investors: U.K. government.

🇮🇳 Earthful, ₹26 crore ($3M) in pre-Series A, plant-based nutrition products. Investors: Fireside Ventures, V3 Ventures,and Atrium Angels.

🇪🇪 ÄIO, €1.2M ($1.4M) grant, sustainable non-animal fats and oils through fermentation. Grantor: Enterprise Estonia.

INVESTMENT CLIMATE PODCAST

Felix Leonhardt of Oyster Bay Capital, on how to get funded

This week, Alex Shandrovsky met with Felix Leonhardt, Partner at Oyster Bay Capital, to unpack what it really looks like to raise and run a €100M+ impact food/ag fund in today’s market—and how founders can learn from the GP playbook. Alex: “We got into why they deliberately built a “proof-of-partnership” SPV between Fund I and Fund II (four concentrated deals), why they sized Fund II around having enough firepower to lead seed, lead/co-lead Series A, and still follow into B, and how painful “errors of omission” (not being able to follow on) shaped their strategy.”

Felix breaks down fundraising as a pure sales funnel (ICP, pipeline, conversions) and explains why “two years is normal” when LPs are trusting you for a decade—plus the unique frustration that funds don’t create urgency until the very end. Finally, Alex and Felix talked about why Oyster Bay’s LP base is heavily food-industry operators (mid-sized, capital-rich businesses who feel disruption directly), why that doesn’t limit their investing (because it matches their thesis), and what they want most from the community: more high-quality deal flow that can genuinely move the food system forward.

The full conversation can be found on Spotify and Apple Podcasts.

Top three findings from this conversation:

Fundraising a Fund Is Still Just Sales (Treat It Like a Funnel). Felix frames fund fundraising the same way he sold vegan ice cream: define your ICP, build a pipeline, work the funnel. The mindset shift matters—LPs are giving you money for ~10 years, so a 2-year sales cycle is normal, not a failure. That realism keeps you consistent instead of being emotionally reactive. ” Now I think any fundraising process is a sales process. It's a funnel. I have a customer profile, and I have different sorts of customer segments. I just need to understand which ones are the most likely ones to convert and obviously focus on these and build a pipeline of leads that we can target.”

The Real Lesson From Fund I: Under-Following Is the Most Expensive Mistake. Oyster Bay VC didn’t size Fund II bigger for ego—they sized it so they could lead, follow on, and have governance strength. Fund I picked strong companies, but the fund was too small to keep firepower for follow-ons, which cost upside. They also saw cases where being a small investor meant watching “wrong” decisions without leverage to influence outcomes. “The error of omission… is the most costly and most painful one… we missed out on a lot of upside because we couldn’t follow on.”

Your Best LPs Might Not Be “Institutional LPs” (Food Industry Families > Traditional Fund Allocators). They learned that many classic institutional fund allocators weren’t the match: the fund is “too small” for them and the sector is niche. Instead, Oyster Bay’s best-fit LP base became mid-sized to large food-industry owners/operators who feel disruption, don’t have big innovation departments, and value access to dealflow + insight. “We learned quite quickly that… traditional fund investors are not our LPs… for us it’s the food industry.”

NOTEWORTHY

The chicken boom, the Kernza bet, and the collapse of a FoodTech pioneer

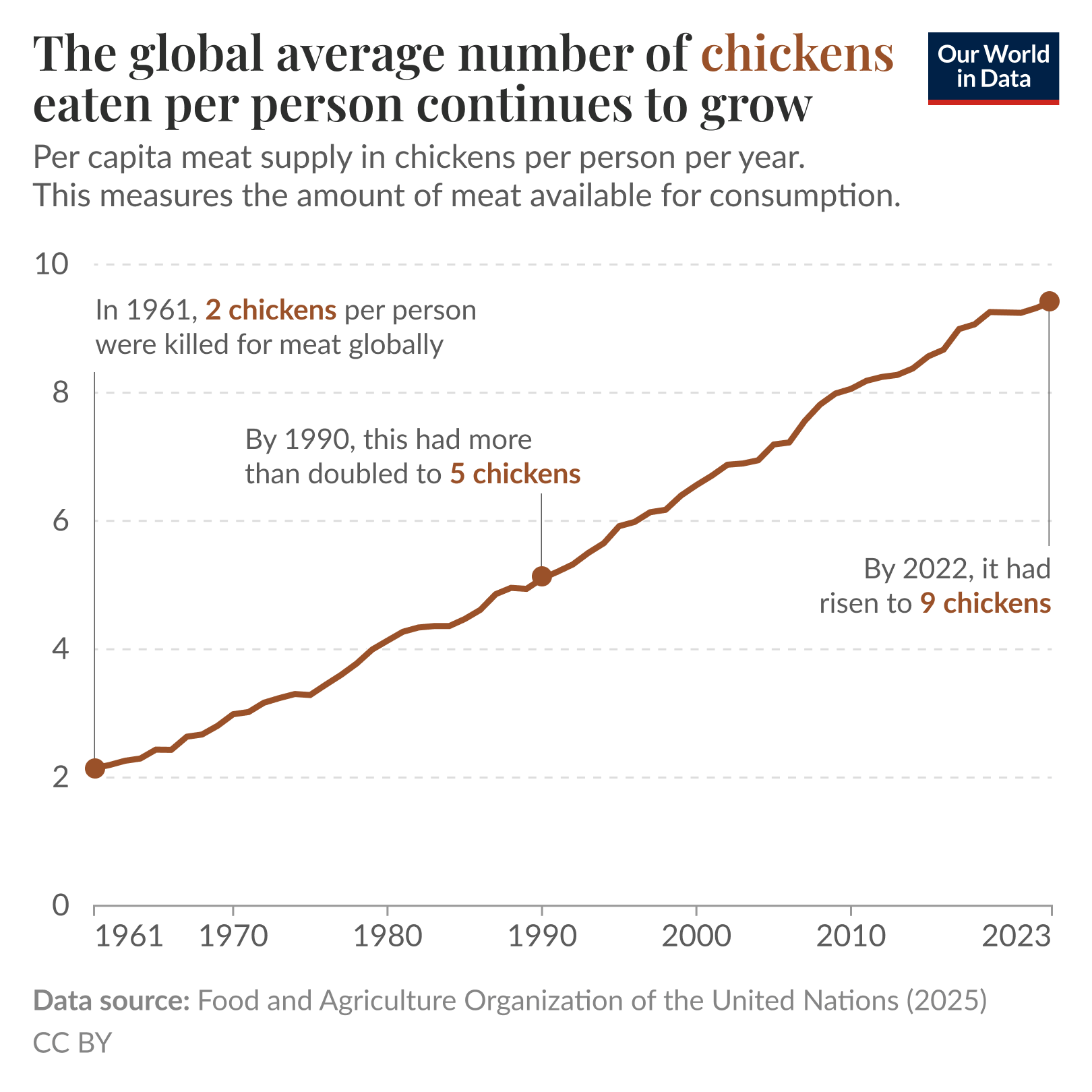

🤯 Global per capita chicken consumption has quadrupled since 1961. On average, 9 chickens are killed each year for every person in the world. Chickens have also become much heavier, so the amount of meat eaten in kilograms has grown even faster.

🧑🏼🌾 The USDA has announced a $700M Regenerative Pilot Program to help U.S. farmers ‘adopt practices that improve soil health, enhance water quality, and boost long-term productivity.’

🤝 Bühler Group and Pow.Bio partnered to launch an integrated continuous precision-fermentation platform that accelerates biomanufacturing scale-up, cuts production costs, and boosts performance, designed to offer companies a faster, more efficient alternative to traditional fed-batch systems.

🥀 Indoor vertical farming pioneer AeroFarms, which was founded already in 2004 and had raised hundreds of millions of dollars over the years, is ceasing operations, closing its final farm, and laying off hundreds of employees. Industry analyst Adam Bergman has these quick reflections on the AeroFarms news.

🐟 Mati Foods is launching mycoprotein-based fishless fillets in Estonian supermarkets like Coop and Prisma as well as restaurants.

🐔Swedish AgTech company HEFT, which has developed a new technology for more humane stunning and euthanasia of pigs and poultry, has secured a financing round of SEK 7M ($750K) to carry the company through the final phase of the EFSA regulatory process, according to information shared with FoodTech Weekly. The company now plans to raise a larger funding round ahead of the upcoming EU approval and market launch.

🌾 Inside the perennial grain revolution: How Kernza could cut emissions, restore degraded soils, and transform agriculture sustainably, despite yield challenges.

NEWS FROM THE FTW COMMUNITY

EIT Food launches Seedbed Venture Catalyst, VEGPRENEUR 2025 winners revealed

🇪🇺 EIT Food has launched its new Seedbed Venture Catalyst initiative, calling all venture builders and venture studios in AgriFood across Europe to apply. Apply by Feb 6, 2026 — more info here.

🏆 The winners of the the 2025 VEGPRENEUR Awards have been announced, after 500 individual tastings by dozens of judges in NYC and L.A.

SPONSORED:

Powered by the next-generation CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

RANDOM STUFF

Innovations, Cautionary Tales, and the Hidden Costs of Convenience

Inside the mouth of this anchovy, plankton particles are captured by the gill arch system. Image Credit: Jens Hamann

🐟 Researchers at the University of Bonn have created a fish-inspired washing machine filter that mimics the gill arch system to remove over 99% of microplastics from wastewater without clogging.

🌭 The Price of Arrogance: How not to raise prices. An interesting case study of Disney+. This reminded us of Costco CEO Jim Sinegal's message to then-COO Craig Jelinek, circa 2008: “If you raise the f----ing hot dog price, I will kill you. Figure it out.”

👹 What are super pollutants? A factsheet provided to you by Climate & Clean Air Coalition and a deep dive analysis by Nick van Osdol and Lauren Singer.

🛵 Is food delivery killing restaurants? Delivery has turned America into a nation of order-inners. And speaking about restaurants, could dynamic pricing lead to cheaper dining?

We love you.

Daniel & Ilkka

- - -

🎵 This issue was produced while Daniel was listening to O by Coldplay, and Ilkka was listening to The Last of the Bearing Beats by Dead Shape Figure.

THE LEFTOVERS

Written by Daniel Skavén Ruben and Ilkka Taponen.

Did someone forward this email to you? Subscribe here.

Thank you for being a Premium subscriber! ❤️ It helps us cover the time and money we spend on producing FoodTech Weekly.

THE LEFTOVERS

Written by Daniel Skavén Ruben and Ilkka Taponen.

Did someone forward this email to you? Subscribe here.

Become a Premium subscriber of FoodTech Weekly for just $5/mo. This helps us cover the time and money we spend on paid newsletters and databases to stay updated on the FoodTech ecosystem. And you’ll get rid of ads. Plus, we’ll send you a food-themed book that we love, once a year.