#278

Hi there,

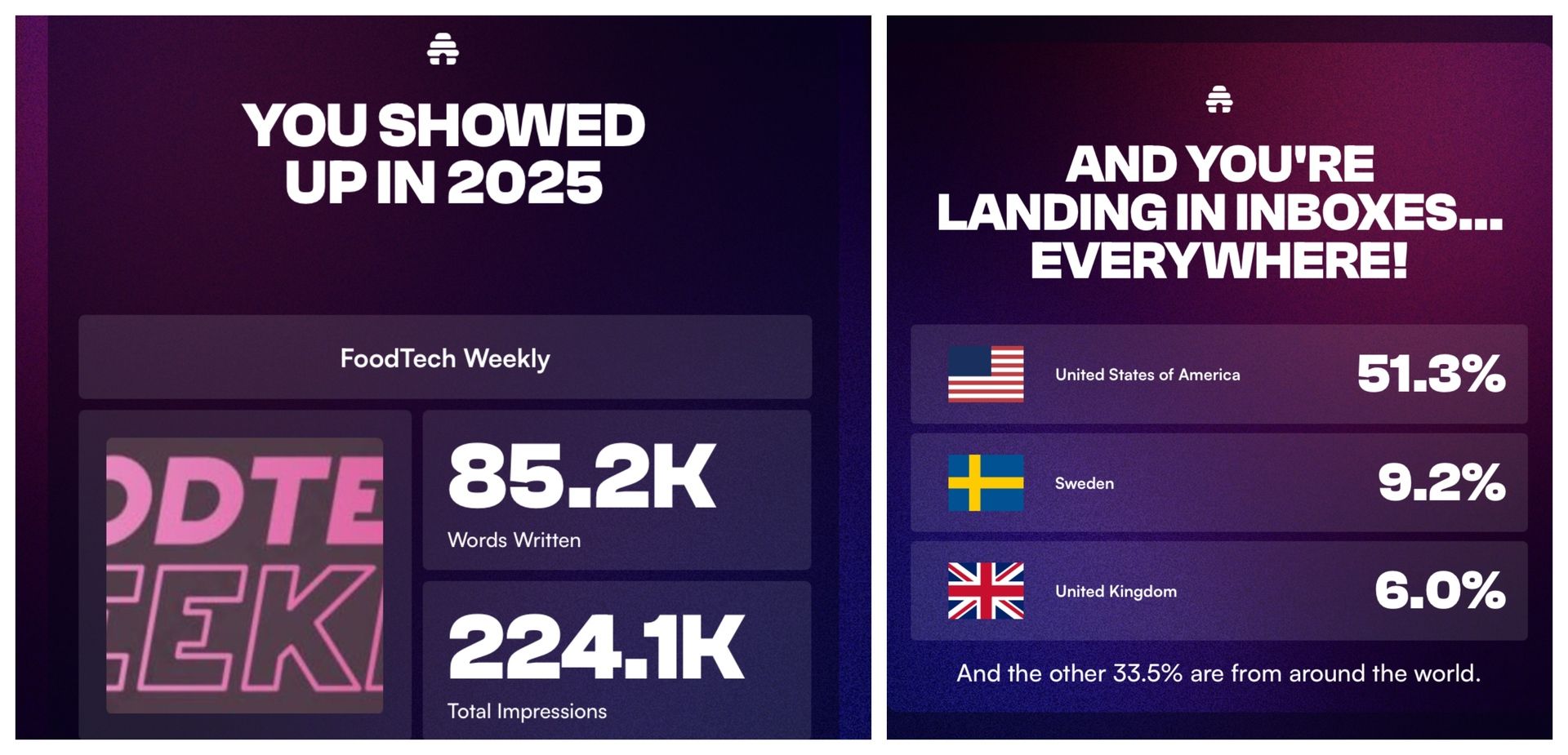

In 2025, we published over 85,000 words (a full-length book!) and reached 3,000+ readers around the world. Pretty cool.

As always - if you find value in FoodTech Weekly, tell a friend (and if you find it insufferable, inflict it on an enemy).

In 2026, we’re focused on making FoodTech Weekly even sharper, deeper, and more valuable. Next week, we’ll share a roundup of the most-read FoodTech Weekly stories of the year. Until then, here’s this week’s rundown:

🥩Dutch cultivated pioneer Mosa Meat bags €15M, while next-door industry peer Meatable ceases operations

💶 Danish Evodia Bio raises €6M for fermentation-based aroma ingredients

🏆 The top 10 FoodTech wins of 2025

Today’s newsletter was sent to {{active_subscriber_count}} subscribers. Welcome to FoodTech Weekly.

SPONSORED:

Easy setup, easy money

Making money from your content shouldn’t be complicated. With Google AdSense, it isn’t.

Automatic ad placement and optimization ensure the highest-paying, most relevant ads appear on your site. And it literally takes just seconds to set up.

That’s why WikiHow, the world’s most popular how-to site, keeps it simple with Google AdSense: “All you do is drop a little code on your website and Google AdSense immediately starts working.”

The TL;DR? You focus on creating. Google AdSense handles the rest.

Start earning the easy way with AdSense.

FUNDING

Mosa Meat snags €15M to keep cultivated meat sizzling

Mosa Meat

🇳🇱 Mosa Meat, €15M ($17.6M), cultivated meat. Investors: Invest-NL, LIOF, PHW Group and Jitse Groen.

🇩🇰 Evodia Bio, €6M ($7M), fermentation-based natural aroma ingredients for beverages and food. Investors: RA Capital Management, Wild Radicals, Francis Family Funds, Export and Investment Fund of Denmark, Ananke Ventures and Newtree Impact.

🇸🇪 Sproud, SEK 20M ($2.2M), pea-based plant milk. Investors: Findeln Holding, Dream Beverage Group, VGC Partners, and Lantmännen BioRefineries.

🇸🇪 Big Akwa, SEK 7.85M ($855K), land-based trout farming system. Investors: Existing backers such as Almi Invest and Sparbanksstiftelsen Norrlands Riskkapitalstiftelse.

INVESTMENT CLIMATE PODCAST

Veronica Breckenridge of First Bight Ventures on how to get funded in 2025

This week, Alex Shandrovsky sat down with Veronica Breckenridge, Managing Partner of First Bight Ventures, for a deep, no-nonsense look at why most industrial biotech companies fail—and how a different investment model can actually work.

‘We talk about why “industrial biotech is not venture-backable” is a lazy myth, how CapEx-heavy businesses can deliver strong equity returns if founders know how to finance assets without burning dilution, and why SaaS-style thinking has done real damage to biomanufacturing.‘

Veronica unpacks her thesis around drop-in, cost-parity technologies, design-for-manufacturability, early strategic validation, and why she avoids product-market risk like the plague. Alex and Veronica dig into her portfolio decisions, including a rare AgriFood bet, the role of non-dilutive capital (including DoD and government funding), why green premiums don’t exist but health premiums do, and why most exits in this space will be disciplined M&A—not unicorn fantasies.

Key Facts First Bight Ventures: Capture the massive value creation opportunity, a multi-trillion-dollar industrial transition from petroleum to biology-based manufacturing for chemicals and materials.

Full conversation on Spotify and Apple Podcasts.

Alex’s Top Findings:

Industrial Biotech Is Venture-Backable (If You Finance CapEx Correctly). Veronica’s core contrarian belief is that industrial biotech isn’t “uninvestable” — founders just finance it incorrectly. When CapEx is funded with project finance, credit, or non-dilutive capital instead of equity, companies can still generate strong venture-style returns without relying on SaaS-like margins. ” The biggest contrarian I think for me is industrial biotech is not worth investing in. My belief is that's not true. 'cause if you know how to leverage, if you understand how to finance that CapEx, without using equity capital, you could still grow an equity. Efficient model in terms of going to market and commercialize so that your equity return can be still solid.”

Early Strategic Buyers De-Risk Exit, Not Just Commercialization. First Bight introduces strategics early — not for optics, but to define specs, manufacturability, and eventual M&A pathways. Veronica won’t invest unless she already sees credible strategic interest shaping the company’s trajectory. “I don’t invest unless I already feel like I’m working with the strategic — they help define the specs you must hit to be acquired.”

Capital Efficiency Is a Strategy, Not A Constraint. Veronica repeatedly contrasts founders who “burn equity” versus those who design the company to qualify for debt, project finance, and grants. Her point is blunt: unless you’re Elon Musk, you can’t raise unlimited capital to pay for expensive mistakes — so the business must be structured to avoid them. “You’re not Elon Musk… you’re not going to raise that kind of money to afford to pay for your mistake.”

NOTEWORTHY

CO₂ is bulking up our food — just not the good stuff

🌡️ Food is becoming more calorific but less nutritious due to rising CO2 levels.

💪 The top 10 FoodTech wins of 2025, according to Green Queen.

💉 US sales of antibiotics for livestock climbed 16% in 2024 vs the year prior, but is still 27% lower than peak sales in 2015, according to new FDA data.

🪦 Dutch cultivated meat startup Meatable, which had raised about $100M over the years, has ceased operations — and the same decision was announced by Canadian plant-based seafood startup Konscious Foods.

🐥 9 animal welfare victories this year.

🏭 Yeastup of Switzerland has opened an industrial-scale facility to turn 4,000 liters of spent brewer’s yeast — every hour — into proteins and functional ingredients.

💩 How many homes could be heated by cow poo?

SPONSORED:

The framework thousands of teams use daily

Organizations worldwide are adopting Smart Brevity to move faster with clearer comms. This free 60-minute session shows you how the methodology works and how to start applying it immediately.

RANDOM STUFF

Plastic vs. real Christmas trees: Which one actually deserves the star?

🎄 Is a plastic Christmas tree better for the environment than a natural one? (by the way, being a (natural) Christmas tree grower is barely profitable).

💡 Liberation Labs released an Industrial Biotechnology Handbook with lessons learned from 100 biotech ventures.

🤩 Size of Life by Neal Agarwal — very cool visualization comparing the size of different organisms on Earth.

📬 Founders who send monthly updates to investors 3-6 months before raising are 3x more likely to close their round — but most founders never send a single one.

🐷 Pig wrestling, but no men allowed.

We love you.

Daniel & Ilkka

- - -

🎵 This issue was produced while listening to Le temps est bon by Bon Entendeur & Isabelle Pierre.

THE LEFTOVERS

Written by Daniel Skavén Ruben and Ilkka Taponen.

Did someone forward this email to you? Subscribe here.

Thank you for being a Premium subscriber! ❤️ It helps us cover the time and money we spend on producing FoodTech Weekly.

THE LEFTOVERS

Written by Daniel Skavén Ruben and Ilkka Taponen.

Did someone forward this email to you? Subscribe here.

Become a Premium subscriber of FoodTech Weekly for just $5/mo. This helps us cover the time and money we spend on paid newsletters and databases to stay updated on the FoodTech ecosystem. And you’ll get rid of ads. Plus, we’ll send you a food-themed book that we love, once a year.