#279

Hi there,

Daniel here, back from the holidays and currently trying to understand reality again:

OK, I got an exciting piece of news to share: I’m bringing on Alex Shandrovsky as Co-Founder of FoodTech Weekly. We’ve known each other for 5+ years, we’re both superconnectors, and we both care deeply about elevating the global AgriFoodTech ecosystem. Here are a few words from Alex:

"I’ve been a devoted FTW reader for at least 4 years, but my bond with Daniel was cemented over bagels in a freezing Stockholm market hall. I am joining as co-founder with one goal: to help you build and exit. My journey ranges from scaling a multi-million dollar catering business from a $3k loan to helping firms raise millions in down markets. Currently leading IR at Ayana Bio, a Boston-based plant cell culture leader, I’ve interviewed founders representing $1B+ in capital and hosted dinners across Dubai, Singapore, and Paris. Based in Israel with my family, I travel one week a month to connect this global network directly to you. I will bring you regular interviews with industry leaders, from founders to investors and beyond. I am also working on premium offerings that will create a lot of value for our ecosystem, and I can’t wait to tell you more about them.”

With Alex and Ilkka by my side, we have a strong team in place to take FoodTech Weekly to the next level.

One more thing: If you’re in Stockholm on Jan 28, come to Urban Deli Hagastaden for a Breakfast Talk where I’ll discuss trends in FoodTech; I’ll be joined by Sofie Z Bonnevier of PopFoodie Media and Gustaf Brandberg of Gullspång Re:food. More info here.

This week's rundown:

💶 Bactolife raises $30M to boost gut health via binding proteins

💰 BlueNalu reels in $11M for cultivated seafood

🚇 A subway built for cats

Today’s newsletter was sent to {{active_subscriber_count}} subscribers. Welcome to FoodTech Weekly.

SPONSORED:

See every move your competitors make.

Get unlimited access to the world’s top-performing Facebook ads — and the data behind them. Gethookd gives you a library of 38+ million winning ads so you can reverse-engineer what’s working right now. Instantly see your competitors’ best creatives, hooks, and offers in one place.

Spend less time guessing and more time scaling.

Start your 14-day free trial and start creating ads that actually convert.

FUNDING

Beyond probiotics: Bactolife bags funding round to scale precision-fermented binding proteins for gut health

Image credit: Bactolife

🇩🇰 Bactolife, €30M ($35M) Series B, binding proteins for improved gut health via precision fermentation. Investors: Cross Border Impact Ventures (CBIV), EIFO (the Export and Investment Fund of Denmark), Novo Holdings and Athos.

🇨🇱 Oxzo, $25M, aquaculture oxygenation technology. Investors: S2G Investments.

🇺🇸 BlueNalu, $11M convertible note / equity, cell-cultivated Bluefin tuna toro. Investors: Agronomics, Siddhi Capital, Lewis & Clark Agri Food, + group of 40 other investors.

🇬🇧 Biographica, £7M ($9.4M) Seed, AI/ML-driven crop trait improvement platform. Investors: Faber VC, SuperSeed, Cardumen Capital, The Helm, Chalfen Ventures and Entrepreneurs First.

INVESTMENT CLIMATE PODCAST

Gentiane Gorlier of The Yield Lab Europe on how to get funded in 2026

Alex: In this episode, I sit down with Gentiane Gorlier, General Partner at The Yield Lab Europe, an early-stage VC fund with 32 investments across the AgriFood value chain. Gentiane shares a refreshingly contrarian view on why animal protein and health remain critical investment areas for the next decade, despite the hype around alternative proteins. We dive deep into why the "Silicon Valley SaaS" model breaks when applied to biology, the harsh reality that consumers will not pay a "Green Premium," and The Yield Lab’s specific playbook for engaging corporate strategics. Currently raising their second fund, Gentiane explains how they help startups navigate the "valley of death" by bringing multiple corporates to the cap table to ensure balance and commercial viability.

The full conversation can be found on Spotify and Apple Podcasts.

Alex’s Top Findings:

The Contrarian Bet: Animal Health is Here to Stay. While many investors pivoted entirely to alt-protein, The Yield Lab Europe maintains that animal protein remains a cornerstone of the global food system. The focus is on efficiency, ethics, and vaccines to reduce emissions per unit, rather than waiting for an alt-protein takeover that isn't technically or economically ready. “We strongly believe that animal protein and animal health should continue to be in the investment thesis for the next years. We absolutely believe that alternative protein is part of the future, but we're simply not there yet... So the real question for us is not whether it exists, but how efficiently and responsibly and ethically it's produced.”

The "Green Premium" is a Myth: Unit Economics Must Lead. The collapse of the insect farming sector and the indoor ag hype cycles taught a brutal lesson: neither consumers nor corporations will pay more just for sustainability. Startups must reach price parity and have a clear path to profitability without relying on a "sustainability tax" that the market refuses to pay. “Nobody wants to pay for sustainability, and that's really something we learn... The economics needs to make sense. Corporate [partners] won't buy your product if it's more expensive... We have seen companies that pivoted away from food ingredients into cosmetics just simply because the food market was not ready to pay the price.”

Strategic Corporate Engagement: The "Two-Corporate" Rule. Engaging corporates too early can burn a startup, but engaging them right is the key to an exit. Gentiane advises against being beholden to a single strategic partner. Instead, aim for two or more strategics to create competitive tension and ensure the startup isn't "manhandled" by one company's internal restructuring or strategy changes. “One of the biggest mistakes startups do is when they go too early to corporate. Because if you go too early, you can burn yourself very easily... [We advise] to try to have at least two corporates on the cap table... So you don't get, let's say, manhandled by only one partner. So if you get the valuable partners that really know what you do, they can help you.”

NOTEWORTHY

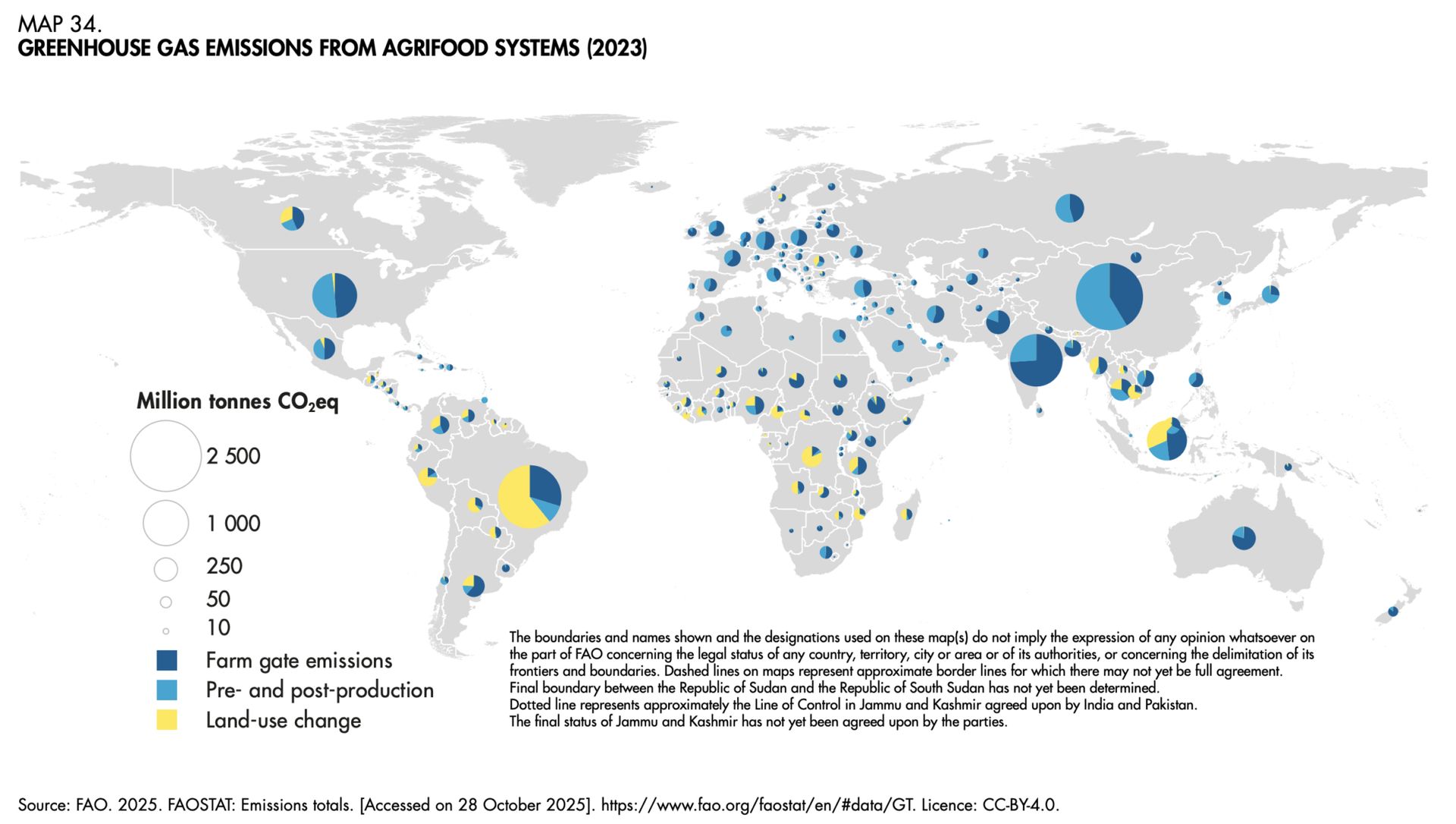

FAOSTAT — one of the world’s largest open data platforms for food, ag, climate, and nutrition —releases its annual yearbook

FAO

🌎 The FAO has released its annual Statistical Yearbook, featuring data on food and ag systems, land use, emissions, and more. Green Queen has highlighted 10 of the most important charts.

🔄 Drones are replacing everything from tractors to planters and planes in ag.

🌽 Should the U.S. change how it produces its dominant crop, corn?

🪦 Aqua Cultured Foods, which used biomass fermentation to produce fish free seafood alternatives, has ceased operations.

💸 Cultivated meat startup Believer Meats was nearly $225M in debt before shutting down recently, new papers show.

NEWS FROM THE FTW COMMUNITY

Last chance to apply for BEAM Accelerator

📅 Last week to apply to BEAM Circular Accelerator 2026. The hybrid 12-week program is open to companies from all over the world interested in scaling up in the North San Joaquin Valley. The program will select five startups turning agricultural waste into value through sustainable agriculture, renewable bioresources, circular biomanufacturing, and waste reduction solutions. Selected companies receive $100K in total support from BEAM Circular: $15K non-dilutive grant, $35K investment, $50K in California Bioeconomy Innovation Campus credits, plus mentorship and strategic network access. Apply here by January 11.

RANDOM STUFF

Solar beats coal, AI ruins dinner, and someone just paid $3.2M for a tuna

⚡️ Renewables like wind and solar overtook coal as the world’s leading source of electricity in 2025. In related news — cheap solar is transforming lives and economies across Africa (New York Times)

😩 How AI slop recipes are ruining holiday dinners.

🐑 50 sheep just stormed a German supermarket, creating havoc

🍫 3D printed chocolate via vending machines are now a thing, apparently.

🐈 Chinese YouTuber Xing Zhilei has gone viral after spending four months building a fully functional mini subway for his cats:

🍱 The operator of popular Japanese restaurant chain Sushi Zanmai just paid $3.2M for a single bluefin tuna, which weighed 242 kg (535 lbs). The cost of the fish was the highest ever price paid at Tokyo’s Toyoshu fish market’s annual start-of-the-year auction. Says the company’s owner, Kiyoshi Kimura: “When I see a good-looking tuna, I cannot resist.”

We love you.

Daniel, Ilkka, and Alex

- - -

🎵 This issue was produced while listening to Dirty Blonde by The Bad Plus.

THE LEFTOVERS

By Daniel Skavén Ruben, Ilkka Taponen, and Alex Shandrovsky.

Did someone forward this email to you? Subscribe here.

Become a Book Club subscriber of FoodTech Weekly for just $5/mo. This helps us cover the time and money we spend on paid newsletters and databases to stay updated on the FoodTech ecosystem. And you’ll get rid of ads. Plus, we’ll send you a food-themed book that we love, once a year. That’s why we call it a Book Club 😀