#282

Hi there,

Daniel here. A few days ago, I stood in front of almost 100 people at Urban Deli in Stockholm to talk FoodTech—what it is, why it matters, and where it's going.

I took this photo before starting my presentation because it’s how I feel on the other side of the mic. I am often nervous when I present and I feel like a deer in the headlights, staring at a wall of expectations. Fanny Sturén of Urban Deli (pictured front) helped cool my nerves.

I didn’t sugarcoat the reality. I highlighted the stark contraction in the market: global FoodTech/AgTech investments have plummeted from ~$50B in 2021 to just ~$10B in 2025. Between the overpromising, the lack of "exit" success stories, and the resulting waves of layoffs and shutdowns, the mood in the sector has been heavy.

Watching the current AI boom from the sidelines, it’s hard not to feel a twinge of envy toward the massive capital and attention flowing that way. But when I find myself spiraling, I look back at this quote by Stefano Bernardi of Unruly Capital. It helps me refocus on why we do this:

‘Recently I've started to realize why I've been so fascinated by and attracted to venture capital. It's [...] one of the most important activities of mankind: the choice of how to allocate resources. Angel investors, venture firms, accelerators, etc [...] all have a bit of a say in what gets built by founders. I believe practicing venture comes with an ethical, moral responsibility to all of your fellow humans on top of your limited partners for what you decide to invest in. Some people decide to invest in the next deployment of scooters around towns or the next 10 minute delivery app, and I think those people are failing all of us. Would you rather come back home to your kid at home and say: "hey! today I've invested in a company that has a slightly better SaaS sales outreach technology" (or whatever) or "today I met with a founder that might solve humanity's quest for infinite energy (proteins, plastics, etc.)”?’

I’d rather be part of the difficult, messy, and essential work of nourishing the world in an environmentally sustainable way than chasing the latest hype. Let’s build things that matter.

This week's rundown:

💶 Solar Foods secures €25M for its single cell protein

💵 Barnwell Bio closes $6M for better bio-surveillance of poultry barns

🪙 Two new €100M-ish funds launch; will invest in e.g. water and food systems

Today’s newsletter was sent to {{active_subscriber_count}} subscribers. Welcome to FoodTech Weekly.

SPONSORED:

Ship the message as fast as you think

Founders spend too much time drafting the same kinds of messages. Wispr Flow turns spoken thinking into final-draft writing so you can record investor updates, product briefs, and run-of-the-mill status notes by voice. Use saved snippets for recurring intros, insert calendar links by voice, and keep comms consistent across the team. It preserves your tone, fixes punctuation, and formats lists so you send confident messages fast. Works on Mac, Windows, and iPhone. Try Wispr Flow for founders.

UPGRADE TO FTW PLUS

The only AgriFoodTech investor database you’ll need

Fundraising for your startup? Or just want to start building relationships with investors ahead of your future raise?

We’ve got you covered. Upgrade to FTW Plus and get:

✅ Full access to our exclusive AgriFoodTech Investor database, covering thousands of AgriFoodTech Investors ($5,000 value)

✅ Access to The Investor Climate Playbook: 50 Interviews With Founders Who Raised in 2025 ($50 value)

✅ FREE 1:1 pitch deck feedback session with an expert ($200 value)

✅ FREE 1:1 investability session with an expert ($200 value)

FUNDING

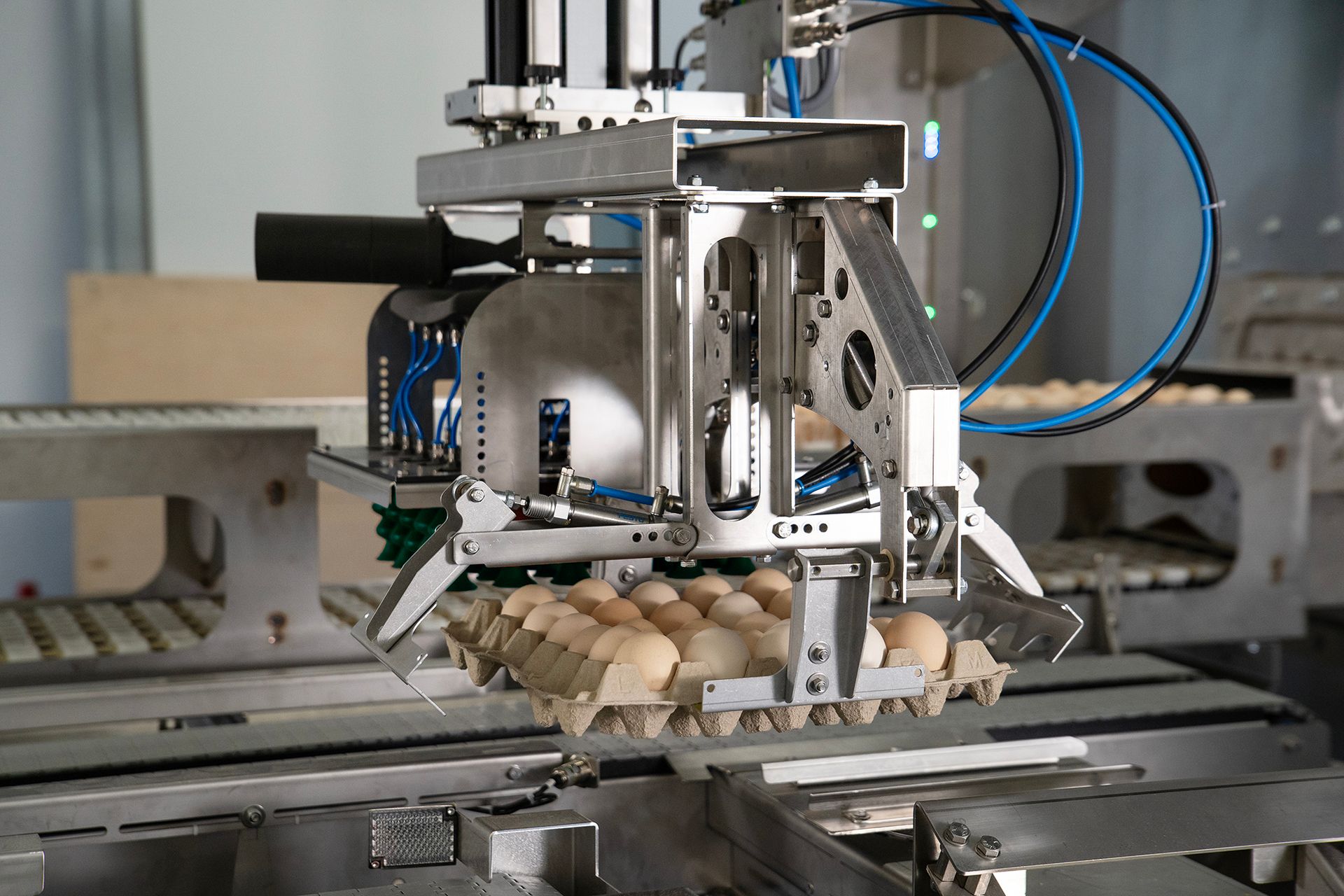

Orbem bags €55M to see inside food to spot defects, which helps cut food waste

In-ovo sexing / Orbem

🇩🇪 Orbem, €55M ($65M) Series B, AI-powered magnetic resonance imaging developer to cut food waste. Investors: Innovation Industries, 83North, General Catalyst, Possible Ventures, Supernova Invest, and other investors.

🇫🇮 Solar Foods, €25M ($30M), producer of single cell protein. Directed share issue.

🇫🇷 Aviwell SAS, €11M ($13.1M) Series A, AI‑driven microbiome discovery and development platform for nature‑based biological solutions for poultry and aquaculture. Investors: Blue Revolution Fund (BRF), Blast.Club, and SWEN Capital Partners.

🇩🇪 Innocent Meat, €6M ($7M), automated cultivated meat platform. Investors: Genius Venture Capital.

🇺🇸 Barnwell Bio, $6M Seed, bio-surveillance for poultry barns. Investors: Twelve Below, Max Ventures, Dorm Room Fund, Banter Capital, Planeteer Capital, AgVentures Alliance, Daybreak Ventures, Alumni Ventures, and AgLaunch Farmers

🇸🇦 Grove, $5M Seed, fresh produce supply chain solution. Investors: Outlier Ventures

🇩🇰 Octarine Bio, $5M Series A, precision-fermented pigments for food, textiles, and personal care. Investors: The Footprint Firm, Edaphon, Unconventional Ventures, DSM-Firmenich Ventures and Oskare Capital.

🇧🇪 Dripl, €4M ($4.8M), Smart, zero-waste water dispensers offering flavoured and functional drinks for workplaces Investors: Abacus Investments, Spadel, Faraday Venture Partners, and the Meert Family.

🇩🇰 Nordic Bio Food, undisclosed sum, combining legumes and enzymes to create high-protein, clean label plant-based foods in familiar format. Investors: Kost Capital, Kost Studio, and biotech pioneers Per Falholt and Steen Riisgaard.

🇩🇰 Ora Biotics, undisclosed sum, next generation precision prebiotic ingredient designed to selectively nourish beneficial gut microbes. Investors: Rockstart and Delphinus Venture Capital.

INVESTMENT CLIMATE PODCAST

GOTA Ventures: Vincent Kuiper shares how to get funded in 2026

In this episode, I sit down with Vincent Kuiper, Co-founder of GOTA Ventures, a European investment syndicate disrupting the traditional VC model. Vincent explains why launching a traditional fund as an emerging manager is broken in the current climate and how he utilized the syndicate structure to aggregate over 50 industry experts from 13 countries. We dive into the mechanics of "deal-by-deal" investing, how to monetize without a management fee, and GOTA’s hybrid thesis that balances 12-year deep tech timelines with the faster liquidity of consumer brands.

🎧 Listen to the full episode (Spotify or Apple Podcasts) to hear how Vincent turned his MBA thesis into a live investment vehicle that targets 8 high-conviction deals a year. Spotify and Apple

Alex’s Top Findings:

The Syndicate Advantage: Speed and "Smart" Access. For emerging managers, raising a fund is expensive and slow. Vincent argues that the syndicate model allows for agility and, crucially, democratizes access. By lowering minimum tickets (to ~€5k), GOTA unlocks capital from industry scientists and operators who have deep expertise but cannot write the €250k check required by traditional LPs: "As an emerging manager, it's simply easier to raise capital for a specific deal than for a fund... We have industry operators, executive scientists, all these kinds of experts that don't have the capital to join a VC fund as an LP, but they do have the capital to join... with lower ticket sizes."

Aligned Economics: The "No Management Fee" Model. Unlike traditional VCs charging a 2% annual fee regardless of performance, GOTA operates on a lean "Closing Fee + Carry" model. This ensures the GPs are fully aligned with the investors—they only make real money if the portfolio companies exit successfully: "The closing fee basically covers our expenses and nothing more than that. So we are fully aligned with our investors that we really need to look for upside in our investment opportunities."

The Hybrid Thesis: Balancing Deep Tech with CPG. GOTA takes a contrarian approach by mixing deep tech (Ingredient Innovation/Infrastructure) with Consumer Brands. Vincent explains this is a deliberate portfolio construction strategy to balance the 10-12 year horizons of deep tech with the potentially faster (5-7 year) exits of consumer goods, offering liquidity diversity to angels: "We combine tech-heavy investments with consumer brands... With the consumer brands, your exits are probably between five to seven years. With the more deep tech plays it's 10 to 12 years and we really believe that the opportunities are in both areas."

NOTEWORTHY

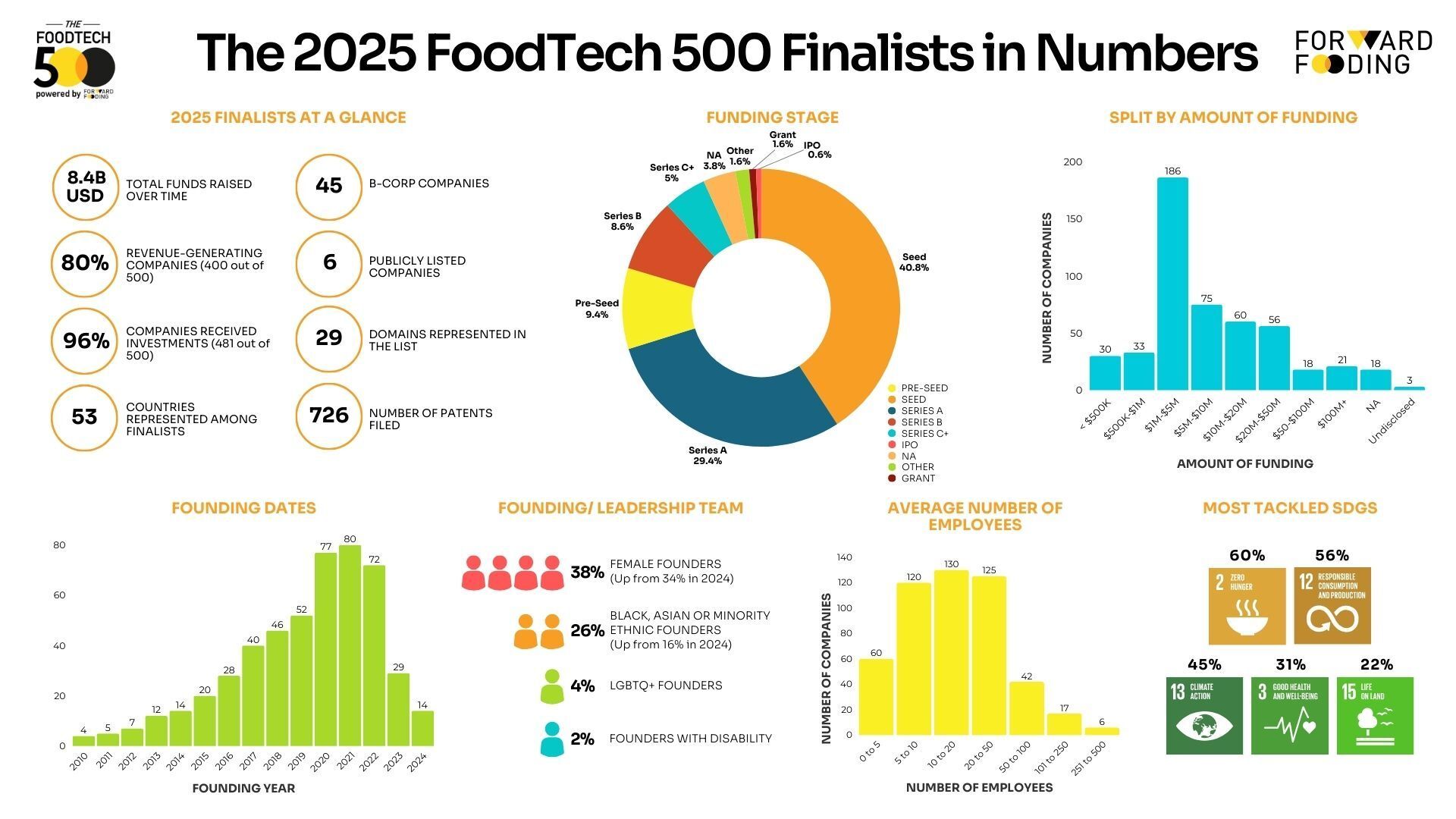

FoodTech 500 reveals a maturing global industry

🏆 Forward Fooding has announced the 500 finalist companies for the 2025 FoodTech 500, marking seven years of identifying and celebrating the world's most groundbreaking AgriFoodTech businesses.

🤝 Swiss fermentation company Planetary is in discussions with India’s Dhampur Bio Organics Ltd. (DBO) regarding a potential collaboration to establish industrial-scale mycoprotein production in India, that could bring the cost of mycoprotein below $1 per kilogram.

🌡️ A new AI tool called CattleFever can take a cow’s temperature using only a photo.

👩🔬 UPSIDE Foods spun out Lucius Labs, a new division focused on developing lower-cost custom cell culture media for life sciences applications, leveraging its cultivated meat expertise to create a new revenue stream.

💶 Amsterdam-based PureTerra Ventures launched its second WaterTech fund, with a €10M investment from Invest-NL, targeting €150M to back early-stage, scalable water-efficiency and reuse technologies.

💶 The Footprint Firm of Denmark has closed their €76M Fund I; the funds focus is on re-seed and seed-stage companies across biotech, energy, AI-powered climate tech, circular manufacturing, the built environment, CO₂ reduction, and food systems. Ticket sizes range from €0.5M to €2M.

💧 Do-nothing hydroponics (Offrange).

NEWS FROM THE FTW COMMUNITY

The hunt for the crispiest fry 🍟

👨🏻💻 Golden Crisp Innovation Challenge 2026 is an invitation to startups, researchers, and companies to bring their best ideas—whether in ingredients, packaging, digital tools, or appliances— to keep fries crisp.

💡Don’t miss AgriFoodTech analyst Adam Bergman’s latest write-up, The Ugly, The Bad, and The Good: The State of the AgTech & FoodTech Sector in 2026.

📈 A new analysis from Systemiq and GFI Europe has found that plant-based foods, cultivated meat, and fermentation could add €111B a year to the EU’s economy by 2040 if treated as a strategic priority. Full report here.

SPONSORED:

Stop guessing. Start scaling.

See the top-performing Facebook ads in your niche and replicate them using AI. Gethookd shows you what’s actually working so you can increase ROI and scale ad spend with confidence.

RANDOM STUFF

Getting spicy

🌶️ A Global Explosion of Absurdly Spicy Foods (Bloomberg)

😍 Book sales are up and independent bookstores are booming.

🚲 From scraps to… tyres? Norway’s reTyre secured €7M ($8.3M) in funding to scale its low-carbon injection-moulding technology for fully recyclable bicycle tyres made from novel materials such as invasive sargassum and oyster shells.

😔 Samsung’s Bespoke AI Family Hub Refrigerator walked away with both the “Overall Worst in Show” and the “Worst in Repairability” at CES. The awards were handed out by a coalition of consumer advocates. Samsung has removed the physical handles so the doors open via voice command, but in certain situations this doesn’t work. The $1,800 to $3,500 (!) fridge also comes with ‘contextual ads’ every 10 seconds on the 32-inch cover screen. Advocates also say the fridge is hard to repair.

Nothing says innovation like getting locked out of your leftovers during a Wi-Fi outage

We love you.

Daniel, Ilkka, and Alex

- - -

🎵 This issue was produced while Daniel was listening to Hometown by French 79.

THE LEFTOVERS

By Daniel Skavén Ruben, Ilkka Taponen, and Alex Shandrovsky.

Did someone forward this email to you? Subscribe here.

Become a Book Club subscriber of FoodTech Weekly for just $5/mo. This helps us cover the time and money we spend on paid newsletters and databases to stay updated on the FoodTech ecosystem. And you’ll get rid of ads. Plus, we’ll send you a food-themed book that we love, once a year. That’s why we call it a Book Club 😀